The Health and Economic Impact of a Global System for Pragmatic Clinical Trials

dfda, cost-benefit-analysis, roi, return-on-investment, clinical-trials, drug-development, health-economics, pragmatic-trials, recovery-trial, real-world-evidence, regulatory-efficiency, decentralized-fda

The bottleneck: 6.65k diseases (95% CI: 5.70k diseases-8.24k diseases) currently lack effective treatments. We have 9.50k compounds (95% CI: 7.00k compounds-12.0k compounds) proven-safe (FDA-approved drugs + GRAS substances), yet only 0.342% (95% CI: 0.21%-0.514%) of drug-disease combinations have ever been tested. At the current discovery rate of 15 diseases/year (95% CI: 8 diseases/year-30 diseases/year), systematically testing all 9.50M combinations plausible pairings would take ~443 years (95% CI: 324 years-712 years). Most will never be tested.

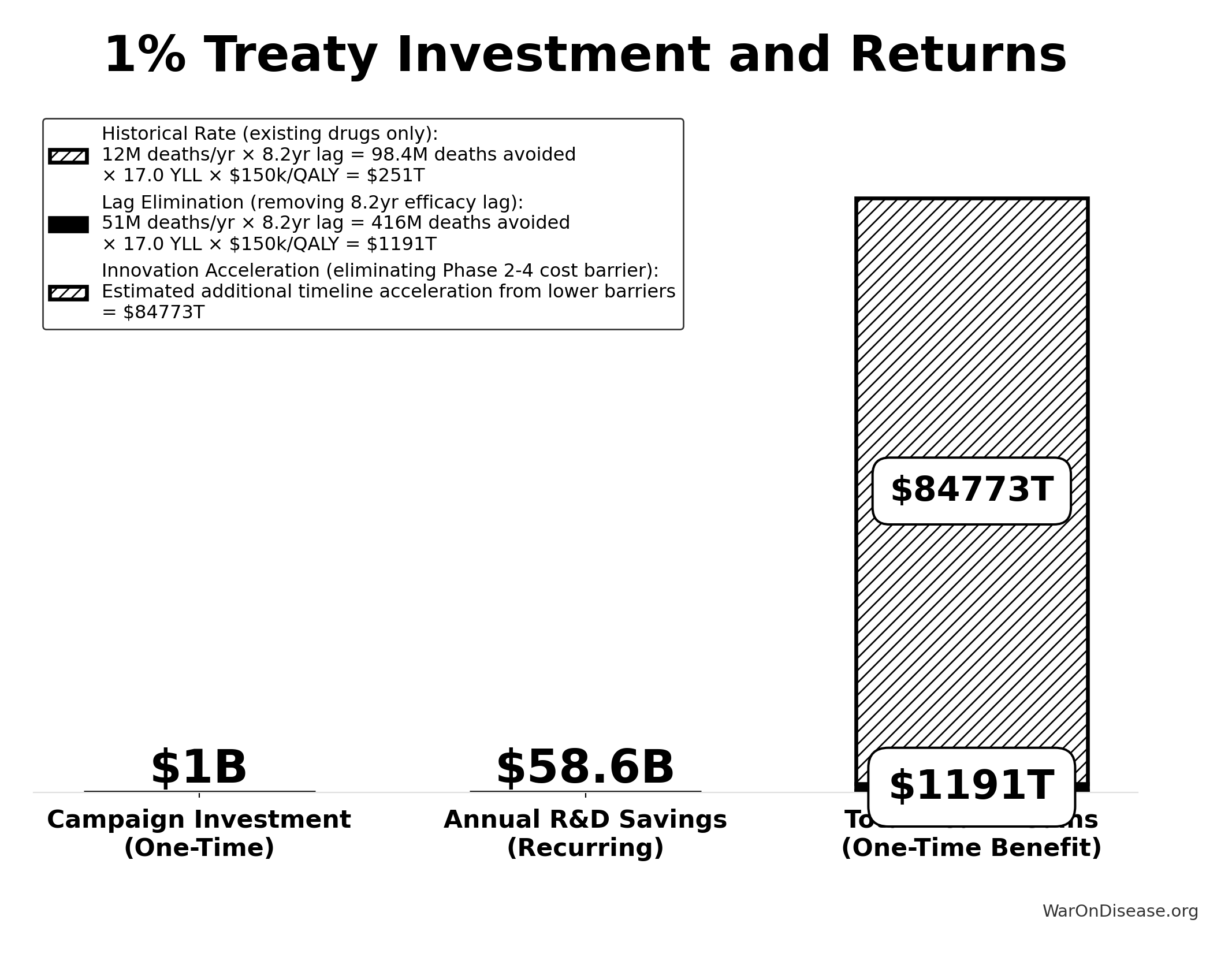

The figures below represent cumulative benefits over the entire acceleration period - the total lives saved by addressing this backlog faster. This is the same methodology used to value smallpox eradication (program cost → total future lives saved) and climate infrastructure investments. These are not annual figures; they are the one-time benefit of permanently accelerating medical progress.

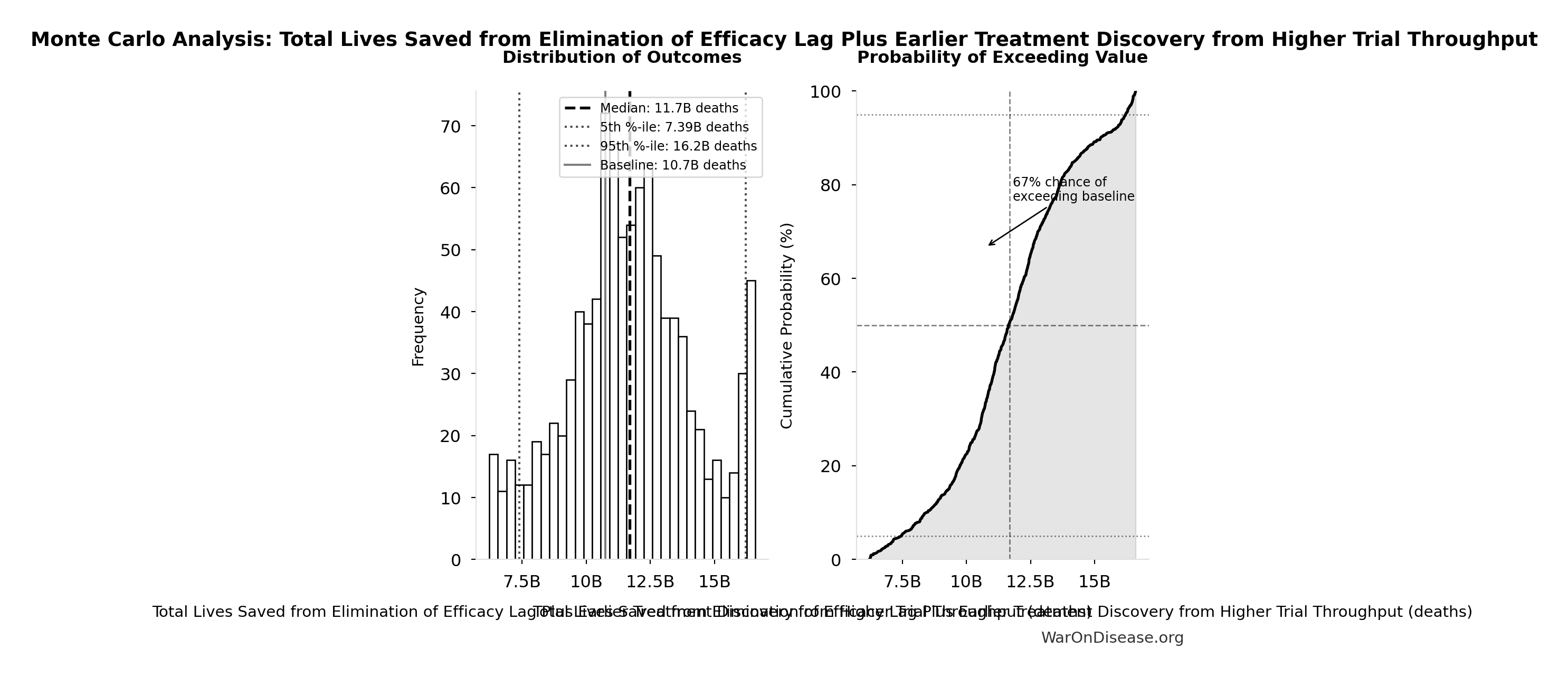

- Lives Saved: 10.7B deaths (95% CI: 7.39B deaths-16.2B deaths) from ~212 years (95% CI: 135 years-355 years) timeline shift

- Suffering Eliminated: 1931T hours (95% CI: 1362T hours-2616T hours) of human suffering averted

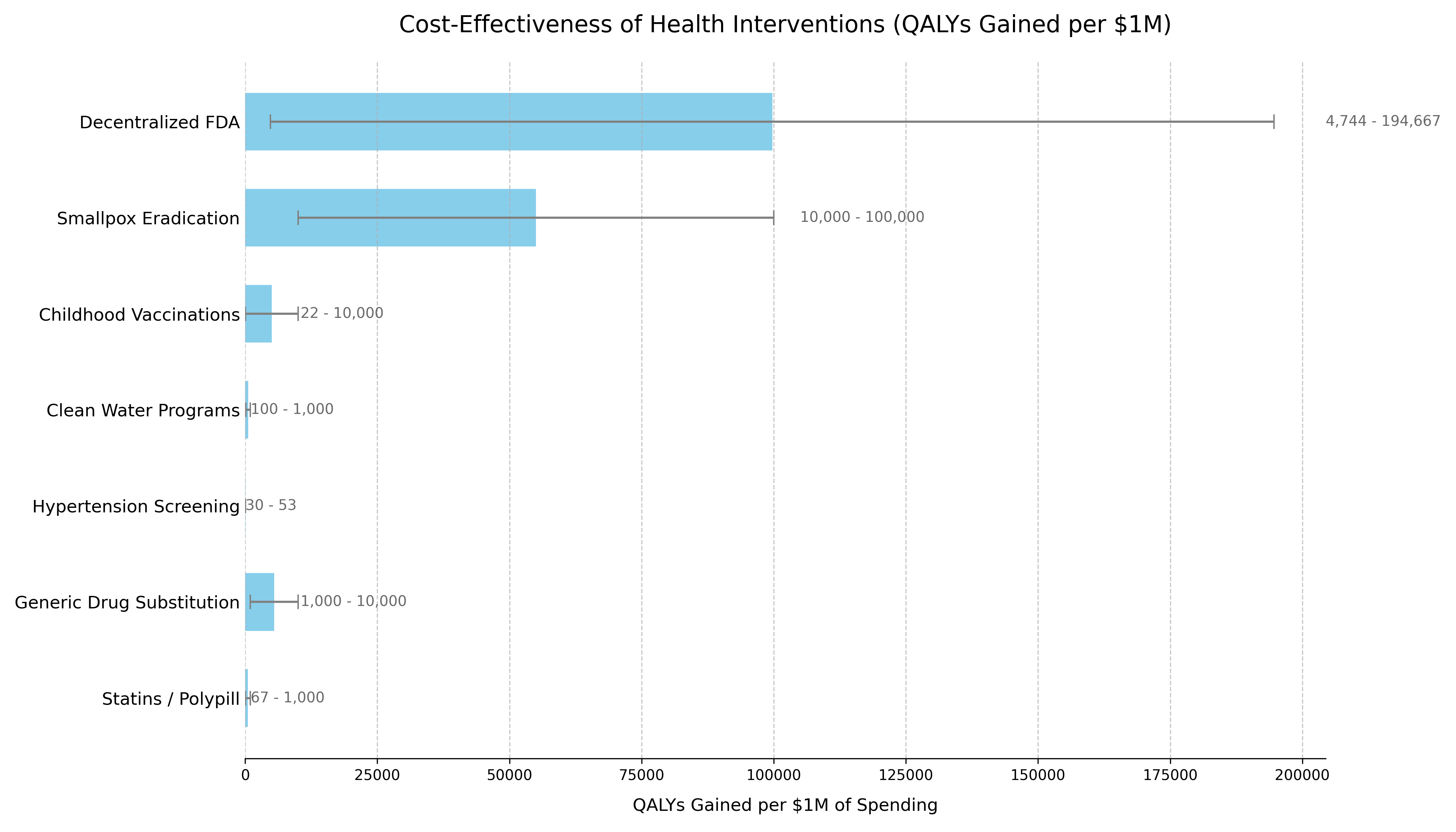

- Cost-Effectiveness: $0.841 (95% CI: $0.242-$1.75)/DALY - competitive with GiveWell’s top interventions (bed nets at $89 (95% CI: $78-$100)/DALY), while operating at vastly greater scale

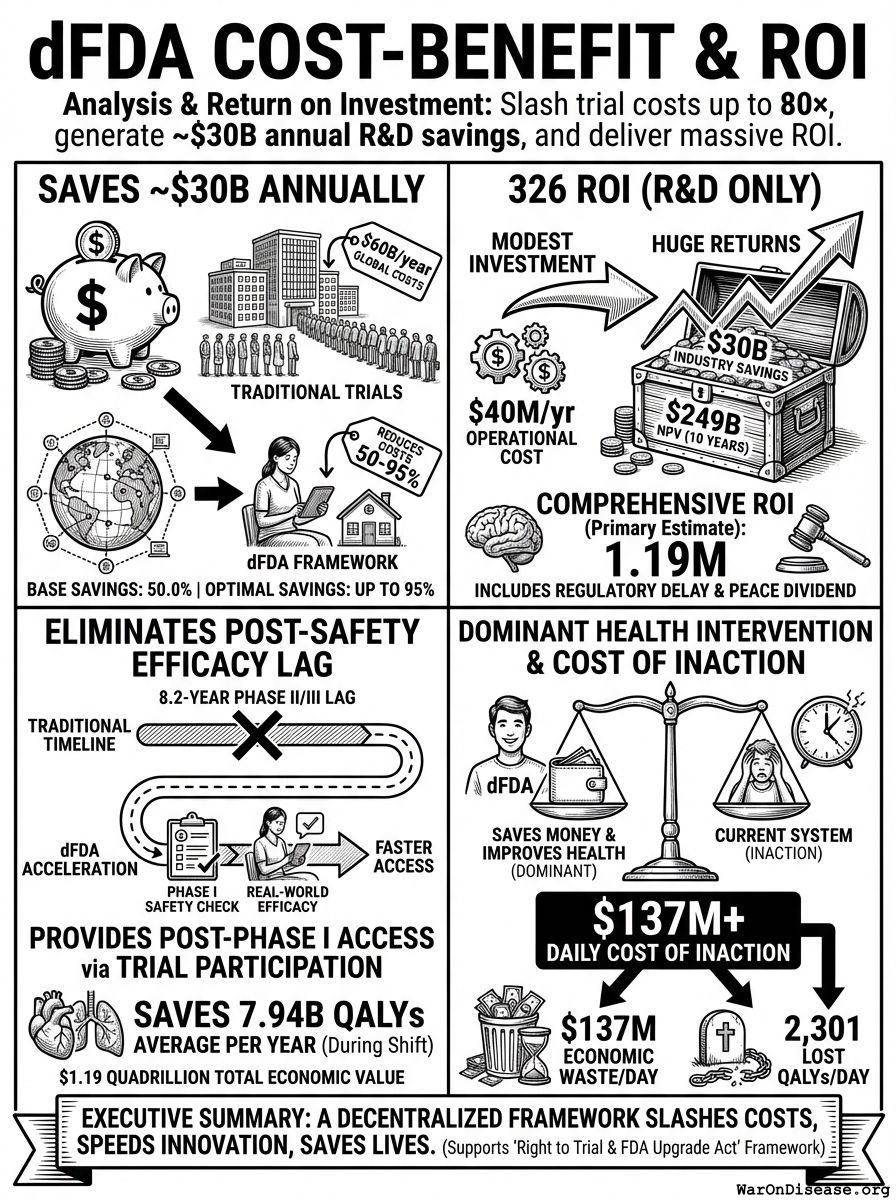

- Dominant Health Intervention: This is a cost-saving intervention that both reduces costs AND improves health outcomes

- Eliminates Post-Safety Efficacy Lag: Eliminates the 8.2 years (95% CI: 4.85 years-11.5 years) Phase II/III delay while preserving Phase I safety testing

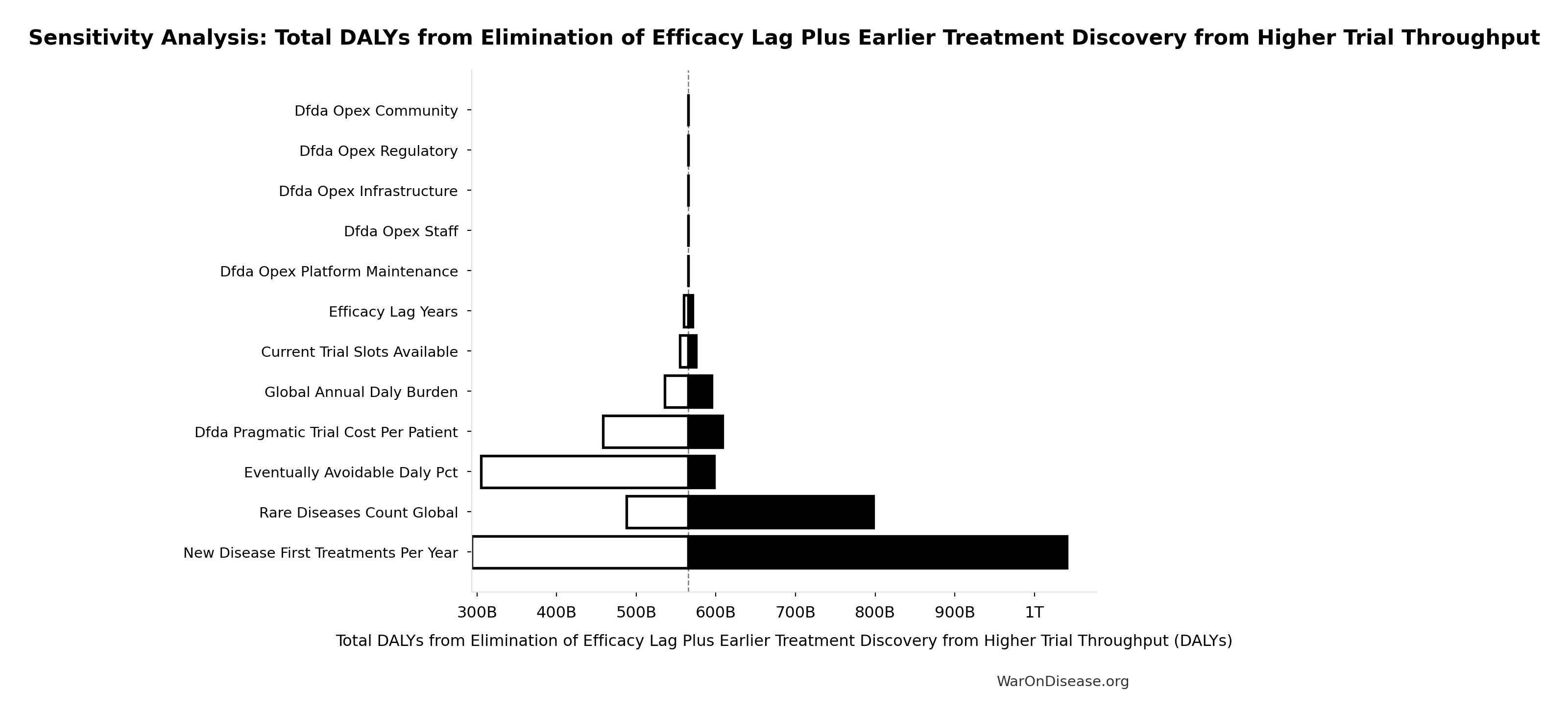

- DALYs Averted: 565B DALYs (95% CI: 361B DALYs-877B DALYs) from full timeline shift (~212 years (95% CI: 135 years-355 years) from 12.3:1 (95% CI: 4.19:1-61.3:1) trial capacity + efficacy lag elimination)

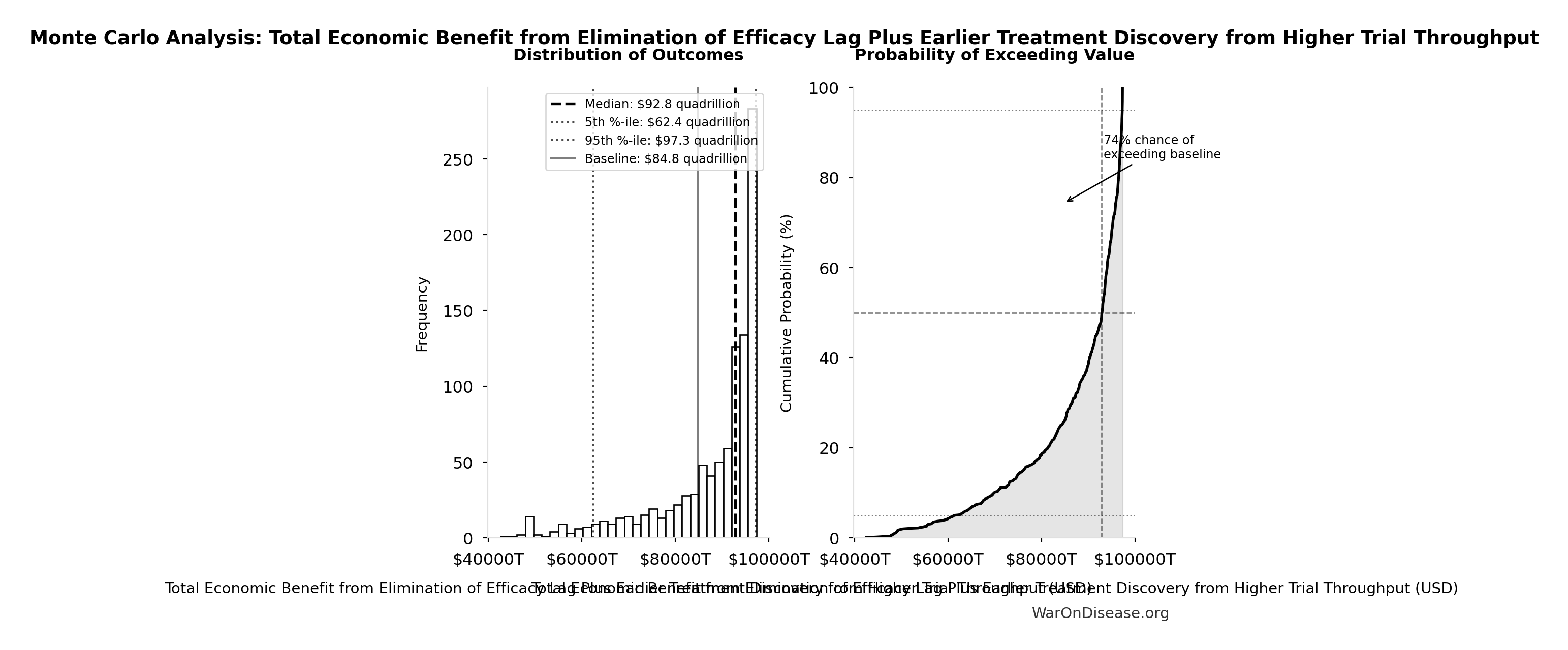

- Total Economic Value: $84.8 quadrillion (95% CI: $62.4 quadrillion-$97.3 quadrillion) (lives saved × standard QALY valuation)

- R&D Savings: $58.6B (95% CI: $49.2B-$73.1B)/year from 97.7% (95% CI: 97.5%-98.9%) cost reduction in clinical trials

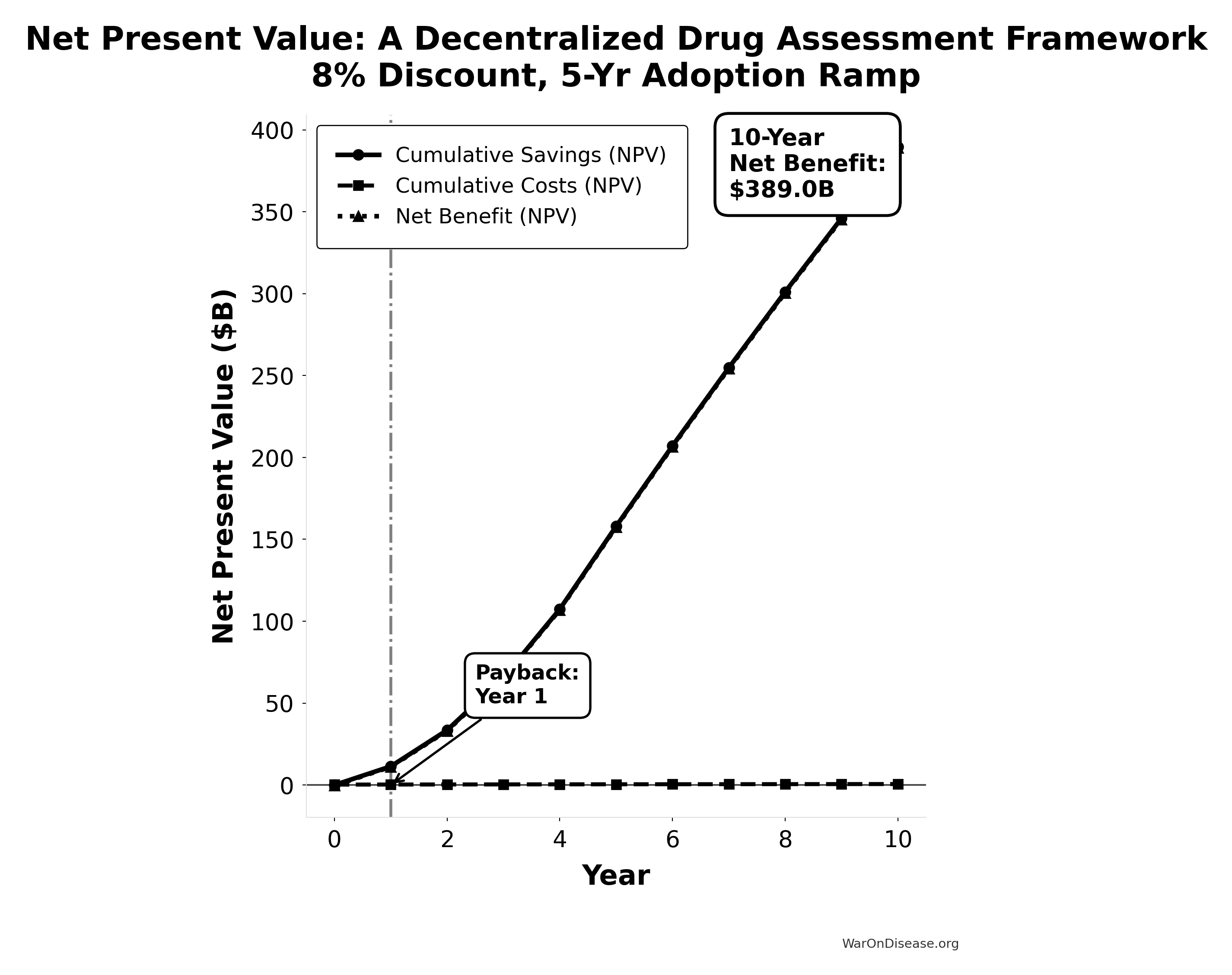

- Return on Investment: 637:1 (95% CI: 569:1-790:1) (10-year NPV basis)

1 Executive Summary

The Problem: Clinical trials cost billions and take a decade per drug. Most humans die before the drugs that could save them finish paperwork. Out of 2.40B people (95% CI: 2.00B people-2.80B people) people with chronic disease, only 1.90M patients/year (95% CI: 1.50M patients/year-2.30M patients/year) participate in trials annually (0.06%).

The Solution: A decentralized framework for drug assessment (dFDA) - an open protocol that enables:

- Subsidized Patient Participation: Patients receive subsidies to participate in trials, making participation accessible and incentivized

- Universal Trial Access: Any patient can join trials from home via their phone or computer - no travel to research centers required

- Real-World Data Aggregation: Outcomes from all participants are aggregated into a unified database

- Treatment Rankings: Like “Consumer Reports for drugs” - every treatment ranked by real-world effectiveness for each condition

- Outcome Labels: “Nutrition facts for drugs” showing exactly what happened to real patients who tried each treatment

How it works: Companies register treatments on the platform. Patients search for their condition, see treatments ranked by effectiveness, and can instantly join trials. Patient-reported outcomes flow back into the rankings. The result is a self-improving system where every patient’s experience helps the next patient make better decisions.

1.1 What You Get

- Cost Cuts: Clinical trials cost 97.7% (95% CI: 97.5%-98.9%) less (44.1x (95% CI: 39.4x-89.1x)). Pragmatic trials like ADAPTABLE ($929 (95% CI: $929-$1.40K)/patient) and systematic reviews (median $97 (95% CI: $19-$478)/patient) prove this works. Apply that globally to the $60B (95% CI: $50B-$75B) spent annually on trials, save tens of billions.

- More Drugs Faster: Cheaper trials mean testing rare diseases and treatments that don’t make billionaires richer. Drugs reach dying people before they finish dying.

- Fewer Dead People: The framework generates 565B DALYs (95% CI: 361B DALYs-877B DALYs) extra life-years through the 212 years (95% CI: 135 years-355 years) timeline shift (from 12.3:1 (95% CI: 4.19:1-61.3:1) trial capacity + efficacy lag elimination), plus faster access, better prevention data, and drugs for diseases companies currently ignore.

1.2 Key Findings

| Metric | Value | Context |

|---|---|---|

| Cost-Effectiveness | $0.841 (95% CI: $0.242-$1.75)/DALY | Competitive with bed nets ($89 (95% CI: $78-$100)/DALY) at vastly greater scale |

| Lives Saved | One-time benefit from 212 years (95% CI: 135 years-355 years) timeline shift | |

| DALYs Averted | Captures both mortality and morbidity | |

| Suffering Eliminated | Human suffering averted from timeline shift | |

| Total Economic Value | $84.8 quadrillion (95% CI: $62.4 quadrillion-$97.3 quadrillion) |

10.7B deaths (95% CI: 7.39B deaths-16.2B deaths) × standard QALY valuation |

| Efficacy Lag Eliminated | Post-Phase I access via trial participation | |

| ROI (R&D Savings) | 44.1x (95% CI: 39.4x-89.1x) cheaper trials | |

| Annual R&D Savings | From 97.7% (95% CI: 97.5%-98.9%) cost reduction | |

| Trial Capacity Increase | Enabling parallel therapeutic space exploration |

Lives Saved:

\[ \begin{gathered} Lives_{max} \\ = Deaths_{disease,daily} \times T_{accel,max} \times 338 \\ = 150{,}000 \times 212 \times 338 \\ = 10.7B \\[0.5em] \text{where } T_{accel,max} = T_{accel} + T_{lag} = 204 + 8.2 = 212 \\[0.5em] \text{where } T_{accel} \\ = T_{first,SQ} \times \left(1 - \frac{1}{k_{capacity}}\right) \\ = 222 \times \left(1 - \frac{1}{12.3}\right) \\ = 204 \\[0.5em] \text{where } T_{first,SQ} = T_{queue,SQ} \times 0.5 = 443 \times 0.5 = 222 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

Suffering Hours Eliminated:

\[ \begin{gathered} Hours_{suffer,max} \\ = DALYs_{max} \times Pct_{YLD} \times 8760 \\ = 565B \times 0.39 \times 8760 \\ = 1930T \\[0.5em] \text{where } DALYs_{max} \\ = DALYs_{global,ann} \times Pct_{avoid,DALY} \times T_{accel,max} \\ = 2.88B \times 92.6\% \times 212 \\ = 565B \\[0.5em] \text{where } T_{accel,max} = T_{accel} + T_{lag} = 204 + 8.2 = 212 \\[0.5em] \text{where } T_{accel} \\ = T_{first,SQ} \times \left(1 - \frac{1}{k_{capacity}}\right) \\ = 222 \times \left(1 - \frac{1}{12.3}\right) \\ = 204 \\[0.5em] \text{where } T_{first,SQ} = T_{queue,SQ} \times 0.5 = 443 \times 0.5 = 222 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

Cost per DALY:

\[ \begin{gathered} Cost_{direct,DALY} = \frac{NPV_{direct}}{DALYs_{max}} = \frac{\$475B}{565B} = \$0.841 \\[0.5em] \text{where } NPV_{direct} \\ = \frac{T_{queue,dFDA}}{Treasury_{RD,ann} \times r_{discount}} \\ = \frac{36}{\$21.8B \times 3\%} \\ = \$475B \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } T_{queue,dFDA} = \frac{T_{queue,SQ}}{k_{capacity}} = \frac{443}{12.3} = 36 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } DALYs_{max} \\ = DALYs_{global,ann} \times Pct_{avoid,DALY} \times T_{accel,max} \\ = 2.88B \times 92.6\% \times 212 \\ = 565B \\[0.5em] \text{where } T_{accel,max} = T_{accel} + T_{lag} = 204 + 8.2 = 212 \\[0.5em] \text{where } T_{accel} \\ = T_{first,SQ} \times \left(1 - \frac{1}{k_{capacity}}\right) \\ = 222 \times \left(1 - \frac{1}{12.3}\right) \\ = 204 \\[0.5em] \text{where } T_{first,SQ} = T_{queue,SQ} \times 0.5 = 443 \times 0.5 = 222 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

This is a capacity vs. backlog model, not “time travel” or a prediction about distant futures:

- What it means: If we must test 9.50M combinations drug-disease combinations to find all effective treatments, the current system (15 diseases/year (95% CI: 8 diseases/year-30 diseases/year) treatments/year) would take ~443 years (95% CI: 324 years-712 years) to work through this backlog. Scaling capacity 12.3:1 (95% CI: 4.19:1-61.3:1)× reduces this to ~36 years (95% CI: 11.6 years-77.2 years).

- The “212 years (95% CI: 135 years-355 years)” represents: The average time a treatment that could be discovered today would have waited under the old system versus the new system.

- Why it matters: Treatments discovered sooner save lives during the intervening period. This cumulative benefit over the acceleration period yields the headline mortality and economic figures.

The scale of impact reflects the scale of the problem, not methodological error.

This analysis measures the total lifetime value of a permanent infrastructure investment - the same approach used for:

- Smallpox eradication: $300M spent → valued at total future lives saved (millions annually, forever), not “lives saved in 1980”

- Climate economics: Social cost of carbon uses infinite-horizon discounting; nobody reports “annual CO2 damage” alone

- Infrastructure projects: Bridges are valued at NPV of all future crossings, not “cars crossed this year”

The dFDA is infrastructure. Like eradicating smallpox or building the interstate highway system, its value IS the cumulative impact. Reducing to annual figures would understate the true ROI and mislead policymakers comparing one-shot programs to permanent infrastructure.

On the “quadrillion” economic value: This exceeds current global GDP because it measures welfare gains (suffering averted, lives extended), not market transactions. Climate change damage estimates similarly exceed GDP. The methodology (Value of Statistical Life × lives saved) is identical to EPA, DOT, and GiveWell standards. If “$89/DALY for bed nets” is credible, so is “$0.84/DALY for dFDA” using the same methodology.

How the 12.3:1 (95% CI: 4.19:1-61.3:1) capacity increase works: With $21.8B/year in trial funding at $929 (95% CI: $97-$3K)/patient (based on ADAPTABLE trial), the system enables 23.4M patients/year (95% CI: 9.44M patients/year-96.8M patients/year) annual trial participants vs. current 1.90M patients/year (95% CI: 1.50M patients/year-2.30M patients/year), increasing trial completion rate from 15 diseases/year (95% CI: 8 diseases/year-30 diseases/year) to 185 diseases/year (95% CI: 107 diseases/year-490 diseases/year). This removes the primary bottleneck to medical progress: currently less than 0.06% of willing patients can access trials, and over 9.50k compounds (95% CI: 7.00k compounds-12.0k compounds) proven-safe (FDA-approved drugs + GRAS substances) remain untested for most conditions they could improve.

Below is a health and economic analysis of a decentralized framework for drug assessment (dFDA). This framework would function as a two-sided marketplace connecting companies with treatments to patients who need them, while continuously aggregating outcomes to rank treatments by real-world effectiveness.

2 Vision and Capabilities

2.1 Core Model: A Two-Sided Marketplace

For Companies (Treatment Providers):

- Register any treatment instantly (drugs, supplements, devices, interventions)

- Set treatment price (covers manufacturing + delivery)

- Get automatic liability coverage

- Receive zero-cost clinical trial data from real-world patient outcomes

For Patients:

- Search any condition, see all treatments ranked by effectiveness

- Join trials from home with one click

- Receive subsidies to offset participation costs

- Report outcomes via simple app interface

- Access “Outcome Labels” showing what happened to similar patients

The Result: A self-sustaining research ecosystem where patients fund treatments (covering costs), provide outcome data (eliminating data collection costs), and the platform publishes continuously-updated treatment rankings (eliminating the publication bottleneck).

2.2 Key Capabilities

- Treatment Rankings: Every treatment for every condition ranked by real-world effectiveness, updated continuously as new data arrives

- Outcome Labels: Standardized “nutrition facts for drugs” showing effectiveness rates, side effects, and outcomes from real patients

- Universal Trial Access: Any patient can participate from anywhere via phone/computer

- Real-Time Surveillance: Continuous data on efficacy, side effects, and drug interactions

- Federated Data Architecture: Data stays in source systems (Epic, Cerner, Apple Health) while queries run across all sources

2.3 Potential Impact on the Status Quo

- Speed of Trials: Reduced overhead and automated data capture can compress timelines.

- Cost of Trials: Using existing healthcare encounters, telemedicine, and EHR data to drastically cut per-patient costs (modeled on pragmatic trials like Oxford RECOVERY and the US-based ADAPTABLE trial).

- Scale & Scope: Potential for testing many more drugs, off-label indications, unpatentable treatments, nutraceuticals, and personalized medicine approaches.

- Innovation Incentives: Lower R&D costs can increase profitability and encourage more entrants/innovation in the life sciences.

3 Addressing Key Concerns

3.1 Why This Differs from Failed Megaprojects

Large-scale interventions face legitimate skepticism. The development economics literature documents numerous failures: infrastructure megaprojects that exceed budgets by 50-100%, foreign aid programs with negative or negligible returns, and “grand challenges” that fail to materialize promised benefits.

This intervention differs in four critical ways:

Proven Technology: Unlike speculative moonshots, pragmatic trials using existing EHR infrastructure have been validated. The RECOVERY trial enrolled 47,000+ patients at $500 (95% CI: $400-$2.50K)/patient. ADAPTABLE achieved $929 (95% CI: $929-$1.40K)/patient in routine US healthcare settings. This isn’t “we hope this works” - it’s “we’ve proven this works, now scale it.”

Marginal Extension, Not Novel System: The framework extends existing clinical trial infrastructure rather than replacing it. Hospitals already have EHRs. Patients already take medications. We’re adding a coordination layer and outcome tracking, not building from scratch.

Self-Correcting Feedback: Unlike infrastructure projects where failures compound, a trial platform has built-in error correction. If a treatment doesn’t work, the data shows it. If costs exceed projections, we can adjust scope. The platform generates its own performance metrics.

Historical Precedent: Smallpox eradication (280:1 ROI) and childhood vaccination programs demonstrate that systematic health interventions can achieve extraordinary returns. The difference: those targeted specific diseases. This targets the discovery process itself, potentially even higher leverage.

Modern Infrastructure Makes This Possible Now: The convergence of electronic health records (Epic/Cerner covering 57% of US hospitals), consumer wearables (billions of devices tracking health metrics), federated data networks (TriNetX queries 300M+ patient records without moving data), and AI-powered analysis enables systematic outcome tracking at scale that wasn’t feasible even a decade ago. This isn’t speculation about future technology - it’s deployment of existing, proven infrastructure.

3.2 Why “Eventually Avoidable” Matters

A critical assumption in this analysis is that 92.6% (95% CI: 50%-98%) of disease deaths are “eventually avoidable” - meaning they could be prevented with sufficient biomedical research over time.

Why this assumption is conservative:

Historical trend: In 1900, life expectancy was ~47 years. Today it’s ~79. Most of that gain came from preventing deaths that were once considered inevitable (infectious disease, childhood mortality, cardiovascular disease).

Known mechanisms exist: For most major disease categories, we understand enough biology to know that interventions are theoretically possible. Cancer is caused by specific mutations. Heart disease has identifiable risk factors. The question is finding the right treatments, not whether treatments can exist.

Already-discovered treatments prove the space: 30% of approved drugs gain new indications, demonstrating that effective treatments exist but haven’t been found yet.

What if this assumption is wrong?

Even if only 25% of deaths are eventually avoidable (half our estimate), the framework still generates 637:1 (95% CI: 569:1-790:1) ROI from R&D savings alone, independent of health benefits. The health impact figures scale linearly with avoidability assumptions, but the cost-saving case doesn’t depend on them.

3.3 Trial Funding Scenario

This analysis models a scenario with $21.8B/year allocated to pragmatic clinical trials. At $929 (95% CI: $97-$3K)/patient, this funds approximately 23.4M patients/year (95% CI: 9.44M patients/year-96.8M patients/year) patient-years annually.

On the Funding Assumption: This analysis demonstrates what becomes possible when the funding constraint is removed. The $21.8B/year figure comes from a proposed 1% Treaty redirecting military spending - but this is one mechanism among many:

- Philanthropic mega-donors: A single Gates Foundation-scale commitment could fund the platform build and initial years

- Sovereign wealth funds: Norway’s $1.4T fund or similar could view this as humanity-scale infrastructure

- WHO/multilateral coordination: Comparable to GAVI or the Global Fund

- Industry consortium: Pharma collectively spends $60B (95% CI: $50B-$75B)/year on trials; even 10% redirection exceeds this threshold

The returns justify the funding, not vice versa. At 637:1 (95% CI: 569:1-790:1) ROI, any rational capital allocator would fund this if they believed the analysis. The question is not “where does the money come from?” but “why hasn’t this happened yet?” (Answer: coordination problems that mechanisms like the Incentive Alignment Bonds are designed to solve.)

Trial Capacity Impact:

| Metric | Status Quo | With Framework |

|---|---|---|

| First treatments/year | 185 diseases/year (95% CI: 107 diseases/year-490 diseases/year) |

|

| Trial capacity multiplier | 1× | |

| Time to test all combinations | ||

| Treatment acceleration | N/A | 204 years (95% CI: 123 years-350 years) earlier |

The Untested Treatment Backlog:

Approximately 6.65k diseases (95% CI: 5.70k diseases-8.24k diseases) lack effective treatments. At current trial capacity (15 diseases/year (95% CI: 8 diseases/year-30 diseases/year)), systematically testing all 9.50M combinations plausible pairings would take ~443 years (95% CI: 324 years-712 years). With 12.3:1 (95% CI: 4.19:1-61.3:1)× capacity, this drops to ~36 years (95% CI: 11.6 years-77.2 years).

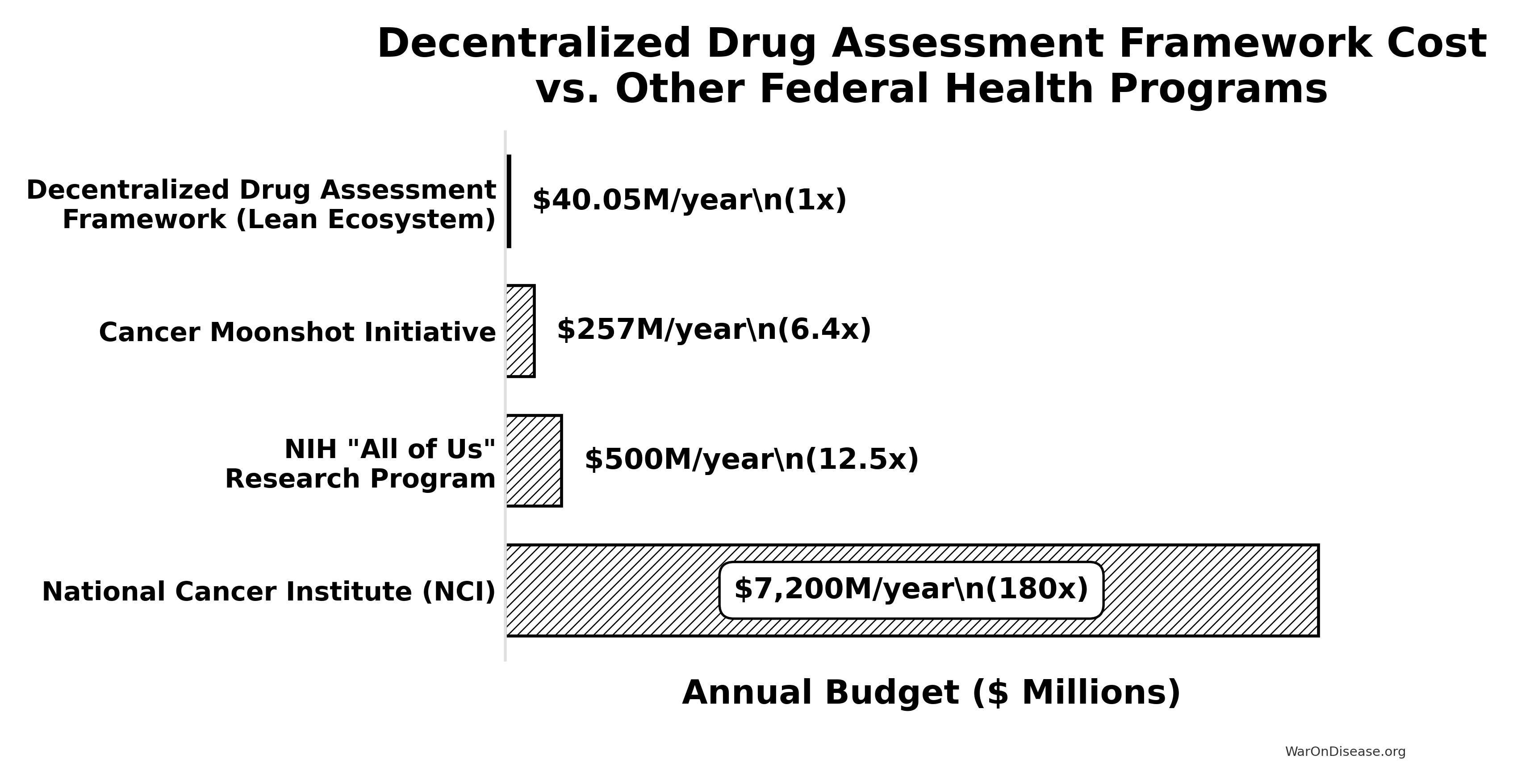

4 Framework Costs (ROM Estimates)

Section Summary - Partnership Approach

Protocol-Only Build (Recommended): - Upfront protocol/API build: $15–25M (vs. $37.5-46M for full platform) - Annual protocol operations: $5–12M (vs. $11-26.5M for full platform) - Partnership integration fund: $20-50M (one-time, to onboard Epic/Cerner/Medable) - Total initiative (partnership model): ~$40-75M upfront, $5-12M annual

Build-Everything Model (Not Recommended): - Upfront full platform build: $37.5–$46M - Annual full platform operations: $11–$26.5 million - Broader initiative (medium scenario): $230M (95% CI: $150M-$350M) upfront, $21.1M (95% CI: $14M-$32M) annual (details)

Key Takeaway: The partnership approach costs 50-75% less than building a competing platform. By establishing an open protocol and leveraging existing infrastructure (Epic, Cerner, Medable, Science 37), you avoid building consumer-facing apps, trial management systems, and global EHR integrations. The protocol layer costs $15-25M to build vs. $500M+ for a full-stack solution.

Existing Infrastructure Value: Companies like Medable ($521M raised), Science 37 ($100M raised), Epic, and Cerner have already invested $1B+ in infrastructure that can be integrated rather than replicated.

This section provides a Rough Order of Magnitude (ROM) cost estimate based on a partnership-first strategy where a dFDA provides open protocol infrastructure rather than competing with existing platforms.

4.1 Upfront Build Costs (30 Months)

Core Engineering & Development Effort:

- Basis: ~75 FTEs 2.5 years $200k/FTE/year

- Activities: Detailed design, Core framework development (API, storage, mapping/validation, auth), reference frontend, initial plugin interfaces, testing, documentation, initial deployment.

The engineering cost is calculated as:

\[ C_{\text{engineering}} = N_{\text{FTEs}} \times T \times C_{\text{FTE}} = 75 \times 2.5 \times \$200\text{k} = \$37.5\text{M} \]

Where \(N_{\text{FTEs}} = 75\) is the number of full-time equivalents, \(T = 2.5\) years is the development timeline, and \(C_{\text{FTE}} = \$200\text{k}\) per FTE per year.

- Estimated ROM: $35 - $40M

Infrastructure Setup & Initial Cloud Costs:

- Activities: Establishing cloud accounts, VPCs, Kubernetes cluster (EKS) setup, database provisioning (RDS/TimescaleDB), S3 buckets, CI/CD pipeline setup, initial IaC development (Terraform).

- Costs: Includes initial compute/storage during development/testing, potential small upfront reservations.

- Estimated ROM: $1 - $3 Million

Software Licenses & Tooling (Initial):

- Examples: Potential costs for monitoring tools (Datadog), security scanners (Snyk), specialized libraries, collaboration tools if not already covered.

- Estimated ROM: $0.5 - $1 Million

Compliance, Legal & Security (Initial Setup):

- Activities: Initial HIPAA/GDPR compliance assessment, policy development, security architecture review, legal consultation for data sharing frameworks.

- Estimated ROM: $1 - $2 Million

The total upfront cost is the sum of all components:

\[ C_0 = C_{\text{engineering}} + C_{\text{infrastructure}} + C_{\text{software}} + C_{\text{compliance}} \]

Where:

- \(C_{\text{engineering}} = \$35 - \$40\) million (Core Engineering & Development)

- \(C_{\text{infrastructure}} = \$1 - \$3\) million (Infrastructure Setup & Initial Cloud Costs)

- \(C_{\text{software}} = \$0.5 - \$1\) million (Software Licenses & Tooling)

- \(C_{\text{compliance}} = \$1 - \$2\) million (Compliance, Legal & Security)

Total Estimated Upfront Cost (ROM): $37.5 - $46M

Note: This ROM estimate focuses only on the Core framework build effort and associated setup. It represents the foundational first step. A full global implementation requires significant additional investment in broader initiatives to achieve goals of global integration, legal harmonization, and massive scale. These crucial, follow-on costs are estimated separately in the Scenario Based ROM Estimates for Broader Initiative Costs section below and include:

- Global EHR/Data Source Integration Effort: Building/buying connectors for thousands of systems worldwide.

- Large-Scale Plugin Development: Funding the ecosystem of data importers, analysis tools, and visualization plugins.

- International Legal/Regulatory Harmonization: Major diplomatic and legal efforts to create a global standard.

- Global Rollout & Adoption: Costs associated with driving adoption and providing training worldwide.

- Massive-Scale Infrastructure: Scaling hardware and cloud resources beyond initial targets to support millions of users.

The following sections provide ROM estimates for both the ongoing operational costs of the Core framework and for these essential broader initiatives.

4.2 Top-Down Analogous Cost Estimation (Market Comparables)

To complement the bottom-up ROM, you can derive a top-down estimate by examining the total investment raised by leading commercial companies developing decentralized clinical trial (DCT) platforms. This market-based view provides a real-world benchmark for the capital required to build, scale, and operate a sophisticated, global-grade platform.

- Medable: A leader in the DCT platform space, has raised a total of $500M in capital, achieving a valuation of $2.1 billion as of late 2021. This level of funding represents the capital required to develop a comprehensive SaaS platform, establish a global presence across 60+ countries, and achieve significant market penetration.

- Other DCT Platform Companies: Other companies in the space, such as Science 37 (~$40M raised), Thread (up to $50M raised), and uMotif (~$25.5M raised), show that you can achieve significant traction and platform development with investments in the tens of millions.

4.2.1 Analogous ROM Conclusion

Based on these market comparables, the total investment required to fund a global initiative for a decentralized framework for drug assessment, from initial build to widespread adoption, can be estimated to be in the range of $50 million to $500M.

- The lower end (~$50M) covers building a solid platform and achieving initial scale, similar to companies like Science 37 or Thread.

- The upper end (~$500M) reflects the multi-year investment for a market-leading, feature-rich global platform with extensive third-party tools, analogous to Medable’s trajectory.

This top-down estimate matches the bottom-up analysis. While a core, open-source framework can start for tens of millions (upfront build ROM), a fully-realized, globally adopted decentralized framework for drug assessment represents a multi-hundred-million-dollar undertaking, consistent with “Medium Case” and “Worst Case” scenarios.

4.3 Annual Operational Costs (5M MAU Target Scale)

Cloud Infrastructure Costs (AWS):

- Components: EKS cluster, RDS/TimescaleDB hosting, S3 storage & requests, SQS messaging, API Gateway usage, Data Transfer (egress), CloudWatch logging/monitoring.

- Basis: Highly dependent on actual usage patterns, data retrieval frequency, processing intensity. Assumes optimized resource usage.

- Estimated ROM: $5 - $15 Million / year (Very sensitive to scale and usage patterns)

Ongoing Engineering, Maintenance & Operations:

- Team Size: Assume ~20 FTEs (SREs, DevOps, Core Maintainers, Security).

- Basis: 20 FTEs * $200k/FTE/year

The ongoing engineering cost is calculated as:

\[ C_{\text{engineering}}^{\text{ops}} = N_{\text{FTEs}}^{\text{ops}} \times C_{\text{FTE}} = 20 \times \$200\text{k} = \$4\text{M}/\text{year} \]

Where \(N_{\text{FTEs}}^{\text{ops}} = 20\) is the number of FTEs for ongoing operations.

- Estimated ROM: $4 - $6 Million / year

Software Licenses & Tooling (Ongoing):

- Examples: Monitoring (Datadog/New Relic), Error Tracking (Sentry), Security Tools, potential DB license/support costs at scale.

- Estimated ROM: $0.5 - $1.5 Million / year

Compliance & Auditing (Ongoing):

- Activities: Regular security audits (penetration tests, compliance checks), maintaining certifications, legal reviews.

- Estimated ROM: $0.5 - $1 Million / year

Support (User & Developer):

- Activities: Tier 1/2 support for platform users and potentially third-party plugin developers.

- Estimated ROM: $1 - $3 Million / year (Scales with user base)

The total annual operational cost is the sum of all components:

\[ C_{\text{op}} = C_{\text{cloud}} + C_{\text{engineering}} + C_{\text{software}} + C_{\text{compliance}} + C_{\text{support}} \]

Where:

- \(C_{\text{cloud}} = \$5 - \$15\) million/year (Cloud Infrastructure Costs)

- \(C_{\text{engineering}} = \$4 - \$6\) million/year (Ongoing Engineering, Maintenance & Operations)

- \(C_{\text{software}} = \$0.5 - \$1.5\) million/year (Software Licenses & Tooling)

- \(C_{\text{compliance}} = \$0.5 - \$1\) million/year (Compliance & Auditing)

- \(C_{\text{support}} = \$1 - \$3\) million/year (Support)

Total Estimated Annual Operations (Platform Only, ROM): $11 - $26.5 Million / year

4.3.1 Marginal Cost Analysis per User

The 5M MAU target is an illustrative milestone used for these initial ROM estimates, not the ultimate goal for the framework, which is to support hundreds of millions or billions of users. At this initial scale, you can analyze the cost on a per-user basis.

- Average Cost Range Per User (at 5M MAU):

- Based on the total annual operational cost range of $11M - $26.5M, the average cost per user is: \[ \frac{\$11,000,000 \text{ to } \$26,500,000}{5{,}000{,}000 \text{ users}} = \mathbf{\$2.20 \text{ to } \$5.30 \text{ per user per year}} \]

- Marginal Cost Per Additional User:

- As a large-scale software platform, a system for a decentralized framework for drug assessment has high fixed costs (infrastructure, core engineering) but very low variable costs. Therefore, the marginal cost of supporting one additional user is expected to be a small fraction of the average cost, likely pennies per year. This cost will decrease further as the framework achieves greater economies of scale, making the system exceptionally efficient at supporting a global user base.

(Note: The underlying cloud infrastructure cost ($5M-$15M/year) is a top-down ROM estimate. A more granular, bottom-up analysis based on projected per-user storage, data transfer, and compute would provide further support for these figures and is a key area for future refinement of this model.)

Note on Participant Financial Contributions:

This cost estimate covers building the technology, not paying patients for trial participation. Trial participation costs would be handled separately through funding mechanisms (government grants, foundation funding, or sponsor payments). The platform manages information but doesn’t move money around directly.

This estimate excludes costs for governance structure and plugin development (though plugin development could be incentivized via bounties).

4.4 Enhanced ROM Estimates and Cost Optimization

Note: This subsection presents ROM estimates using cost-saving strategies including open-source development, bounty programs, and AI automation.

4.4.1 Key Cost-Saving Strategies

- Open-Source Development: Global developer contributions under permissive licenses (Apache 2.0/MIT).

- Bounty Programs: Targeted bounties for features, security audits, and integrations.

- AI-Automated Development: AI coding assistants and automated testing to cut development time and costs.

- Modular Architecture: Parallel development of components by different teams/contributors.

- Existing Open-Source Components: Building on and contributing to existing healthcare/blockchain projects.

4.4.2 ROM Estimates by Technical Component

Blockchain Supply-Chain Ledger

- Components: Zero-knowledge proof implementation, DSCSA integration, IoT device integration

- Cost Reduction: Open-source blockchain frameworks, community bounties for core components

- Estimated ROM: 2M USD upfront / 0.5M USD annual maintenance

Patient Portal & Treatment Ranking System

- Components: Real-time ranking algorithm, outcome labels, mobile/SMS/IoT interfaces

- Cost Reduction: Open-source frontend frameworks, community-developed plugins

- Estimated ROM: 1.5M USD upfront / 0.3M USD annual maintenance

- Interoperability & API Infrastructure

- Components: FHIR-R5 server, EHR integration adapters, OAuth 2.0 implementation

- Cost Reduction: Existing open-source healthcare APIs, community-contributed adapters

- Estimated ROM: 1M USD upfront / 0.2M USD annual maintenance

- Security & Compliance

- Components: FedRAMP-Moderate compliance, annual pen testing, security monitoring

- Cost Reduction: Bug bounty program, automated security scanning

- Estimated ROM: 0.5M USD upfront / 0.5M USD annual

- AI/ML Capabilities

- Components: Protocol validation, patient-trial matching, safety signal detection

- Cost Reduction: Open-source ML models, transfer learning, community datasets

- Estimated ROM: 1M USD upfront / 0.3M USD annual

- Developer & Community Infrastructure

- Components: Documentation, SDKs, CI/CD pipelines, community support

- Cost Reduction: Automated documentation generation, community moderation

- Estimated ROM: 0.5M USD upfront / 0.2M USD annual maintenance

- Governance & Transparency

- Components: Technical Steering Committee operations, public metrics dashboards

- Cost Reduction: Automated reporting, community governance tools

- Estimated ROM: 0.2M USD upfront / 0.1M USD annual

Total Estimated Development (Upfront): 6.7M USD Total Estimated Annual Operations: 2.1M USD

4.5 Cost Optimization Strategies and Risk Mitigation

4.5.1 Bounty Program Implementation

- $1M annual budget for security bounties and feature development

- Structured as graduated rewards based on impact and complexity

- Community-voted prioritization of bounty targets

4.5.2 Open-Source Community Building

- Developer documentation and starter kits ($0.2M initial)

- Hackathons and community events ($0.3M annual)

- Contributor recognition program ($0.1M annual)

4.5.3 AI-Assisted Development

- AI code generation and review tools ($0.5M initial setup)

- Automated testing and validation pipelines ($0.3M annual)

- Continuous training of domain-specific models ($0.2M annual)

4.5.4 Risk Mitigation

- 20% contingency buffer on all estimates

- Phased rollout with clear milestones

- Regular third-party security audits

Total Estimated ROM with Optimization:

- Upfront (Year 1): $8.5M (including contingency)

- Annual Operations (Years 2+): $3.0M (including bounties and community programs)

Note: These estimates assume you use open-source code, get volunteers to help, and let AI do most of the work. This only works if enough people actually contribute and you run the bounty/prize programs well.

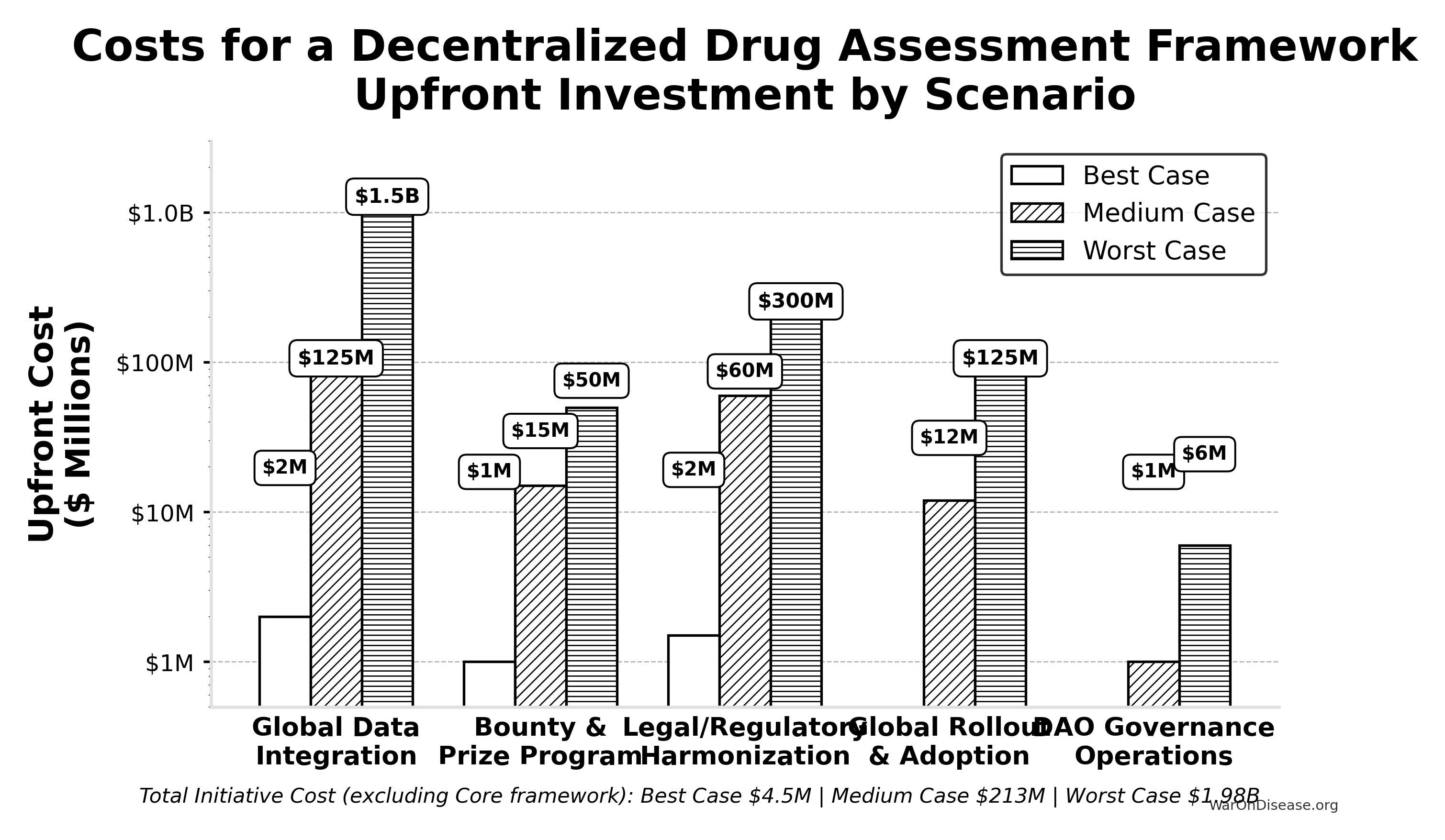

4.6 Scenario Based ROM Estimates for Broader Initiative Costs

This table presents point estimates for each scenario, with the overall range of possibilities captured by comparing the Best, Medium, and Worst Case columns.

| Component | Best Case (Upfront / Annual) | Medium Case (Upfront / Annual) | Worst Case (Upfront / Annual) | Key Assumptions & Variables Driving Range |

|---|---|---|---|---|

| Global Data Integration | $2M / ~$0 | $125M / $10M | $1.5B / $150M | Success of AI/automation, standards adoption, #systems, vendor cooperation. |

| Bounty & Prize Program (Act SEC. 204(i)) | $1M (Prizes) / ~$0 | $15M (Bounties) / $2M | $50M (Major Bounties) / $10M | Success of organic ecosystem growth vs. need to incentivize critical plugin/tool development via bounties. |

| Legal/Regulatory Harmonization | $1.5M / ~$0 | $60M / $3M | $300M / $30M | Effectiveness of AI legal tools, political will, complexity of global law. |

| Global Rollout & Adoption | ~$0 / ~$0 | $12M / $3M | $125M / $30M | Need for training/support beyond platform status, user interface complexity. |

| DAO Governance Operations | ~$0 / ~$0 | ~$1M / $0.3M | ~$6M / $1M | Automation level, need for audits, grants, core support staff. |

| — TOTAL — | ~$4.5M / ~$0 | ~$213M / ~$18.3M | ~$1.98B+ / ~$221M+ | Represents total initiative cost excluding Core framework build/ops. |

4.6.1 Interpretation

Even when pursuing efficient strategies, the potential cost for the full initiative for a decentralized framework (beyond the Core framework) varies dramatically based on real-world execution challenges. The Medium Case suggests upfront costs in the low hundreds of millions and annual costs in the low tens of millions, while the Worst Case pushes towards multi-billion dollar upfront figures and annual costs in the hundreds of millions, dominated by integration, plugin funding, and legal costs if automation and community efforts fall short.

4.6.2 Revised Summary

Based on the detailed technical specification, a ROM estimate suggests:

- Initial Core framework Build (~2.5 years): ~$37.5 - $46M

- Annual Core framework Operations (at ~5M MAU scale): ~$11 - $26.5 Million (These framework operational costs are distinct from the financial flows of patient contributions and the NIH Trial Participation Cost Discount Fund, and also exclude plugin ecosystem costs not covered by platform bounties)

This revised, bottom-up ROM highlights that while the core technology platform build might be achievable within tens of millions, the previously estimated billions likely reflect the total cost of the entire global initiative. This includes massive integration efforts, legal frameworks, global rollout, and the financial ecosystem involving participant contributions and the direct NIH-funded discounts to patient costs, rather than direct platform-disbursed compensation. This conclusion is further supported by the top-down analogous estimate derived from market comparables, which points to a total initiative investment in the range of $50 million to $500M for a commercial-grade equivalent.

5 Benefit Analysis - Quantifying the Savings

This section quantifies the potential societal benefits of an infrastructure for a decentralized framework for drug assessment, focusing primarily on R&D cost savings and health outcome improvements.

5.1 Market Size and Impact

The global pharmaceutical and medical device R&D market is vast. Annual global spending on clinical trials is approximately $60B (95% CI: $50B-$75B). Most of this can be done cheaper with a decentralized framework for drug assessment. If such a framework captures even a fraction of this market by being faster and cheaper, its economic impact will be huge.

- Current Average Costs: Estimates suggest $2.60B (95% CI: $1.50B-$4B) to bring a new drug from discovery through FDA approval, spread across ~10 years.

- Clinical Trial Phase Breakdown:

- Phase I: $2 - $5 million/trial (smaller scale).

- Phase II: $10 - $50 million/trial (depending on disease area).

- Phase III: $100M - $500M/trial (large patient populations).

- Per-Patient Phase III Costs: Often $41K (95% CI: $20K-$120K) per patient (site fees, overhead, staff, monitoring, data management).

5.2 Decentralized Trial Costs Modeled on Pragmatic Trials

Oxford RECOVERY: Achieved ~$500 (95% CI: $400-$2.50K) per patient. Key strategies included:

- Embedding trial protocols within routine hospital care.

- Minimizing overhead by leveraging existing staff/resources and electronic data capture.

- Focused, pragmatic trial designs.

Systematic Review Evidence: A systematic review of 64 embedded pragmatic clinical trials found a median cost per patient of $97 (95% CI: $19-$478)15. This confirms that low-cost execution is a replicable property of the pragmatic design, not an anomaly of any single trial.

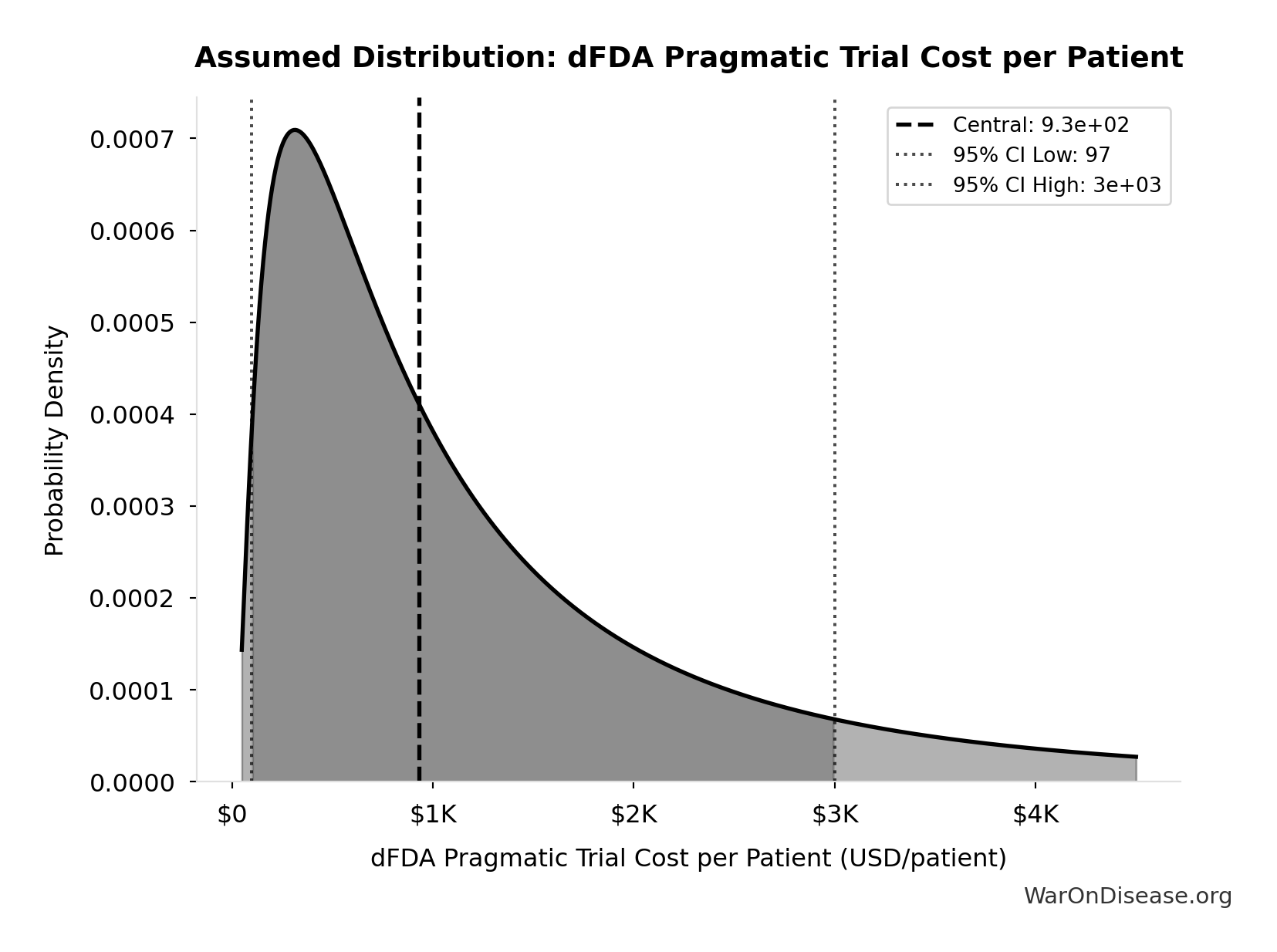

ADAPTABLE Trial (PCORnet): The US-based ADAPTABLE trial ($14M (95% CI: $14M-$20M) / 15.1k patients = $929 (95% CI: $929-$1.40K)/patient) provides a more representative benchmark for pragmatic trial costs in typical healthcare settings without emergency conditions.

dFDA Cost Projection: Our projections use $929 (95% CI: $97-$3K)/patient based on ADAPTABLE. Confidence interval ($500-$3,000) captures range from RECOVERY-like efficiency to complex chronic disease trials.

Input: Pragmatic Trial Cost Distribution

This chart shows the assumed probability distribution for this parameter. The shaded region represents the 95% confidence interval where we expect the true value to fall.

Extrapolation to New System:

- A well-integrated global framework could achieve $929 (95% CI: $97-$3K) per patient in many cases, especially for pragmatic or observational designs.

- Up to ~44.1x (95% CI: 39.4x-89.1x)× cost reduction is achievable by comparing pragmatic trial costs ($929 (95% CI: $97-$3K)) against traditional costs of $41K (95% CI: $20K-$120K).

The cost reduction factor:

\[ \begin{gathered} k_{reduce} \\ = \frac{Cost_{P3,pt}}{Cost_{pragmatic,pt}} \\ = \frac{\$41K}{\$929} \\ = 44.1 \end{gathered} \]

The percentage reduction:

\[ \begin{gathered} Reduce_{pct} \\ = 1 - \frac{Cost_{pragmatic,pt}}{Cost_{P3,pt}} \\ = 1 - \frac{\$929}{\$41K} \\ = 97.7\% \end{gathered} \]

Scope of Cost Reduction: This reduction applies to trials amenable to pragmatic design - approximately 70% of Phase III trial volume by patient count (chronic disease management, comparative effectiveness, dose optimization). First-in-human studies, novel mechanism trials, and high-risk interventions retain traditional controlled protocols. The confidence interval ($500-$3,000/patient) captures this heterogeneity: simple comparative studies approach RECOVERY-level efficiency while complex trials remain closer to traditional costs. The headline 97.7% (95% CI: 97.5%-98.9%) figure represents the weighted average across the addressable trial market, not a claim that every trial achieves this reduction.

5.3 Overall Savings

By Reducing Per-Patient Costs

- If a trial with 5,000 participants costs $929 (95% CI: $97-$3K)/patient, total cost is ~$6 million, versus $200 - $600 million under traditional models.

- This magnitude of savings can drastically reduce the total cost of clinical development.

For a trial with \(x\) participants, the total cost savings is:

\[ S_{\text{trial}}(x) = (c_t - c_d) \cdot x \]

Where:

- \(c_t\) is the traditional cost per patient ($41K (95% CI: $20K-$120K))

- \(c_d\) is the decentralized cost per patient ($929 (95% CI: $97-$3K))

For a trial with \(x = 5,000\) participants, savings are approximately:

\[(\text{Traditional} - \text{Pragmatic}) \times 5{,}000 \approx \$194\text{M per trial}\]

Volume of Trials & Speed

- Faster, cheaper trials allow more drug candidates, off-label uses, nutraceuticals, and personalized dosing strategies to be tested.

- Shorter development cycles reduce carrying costs and risk, further increasing ROI for sponsors.

Regulatory Savings

- A single integrated platform with automated data audits cuts bureaucratic duplication across multiple countries, drastically lowering compliance costs.

Increased Competition Among Sponsors

- The transparent nature of such a framework’s infrastructure creates a competitive environment. Sponsors are incentivized to submit efficient trial designs and lean operational costs to attract patient participation, further driving down R&D expenditure beyond the technical efficiencies of decentralized trials.

5.4 Economic Value of Earlier Access to Treatments

- Faster approvals and access to effective treatments can save lives and improve quality of life.

- Value of a Statistical Life (VSL): U.S. agencies use ~$10M (95% CI: $5M-$15M) per life saved.

- QALY Framework: Standard willingness-to-pay is $100,000–$150K (95% CI: $100K-$199K) per QALY gained.

- Example Calculation: If faster access saves 10,000 QALYs/year, annual benefit = 10,000 × $150K (95% CI: $100K-$199K) = $1.5B. If 10,000 lives are saved, benefit = 10,000 × $10M (95% CI: $5M-$15M) = $100B.

- These benefits are additive to direct cost savings and can be substantial depending on the scale of acceleration.

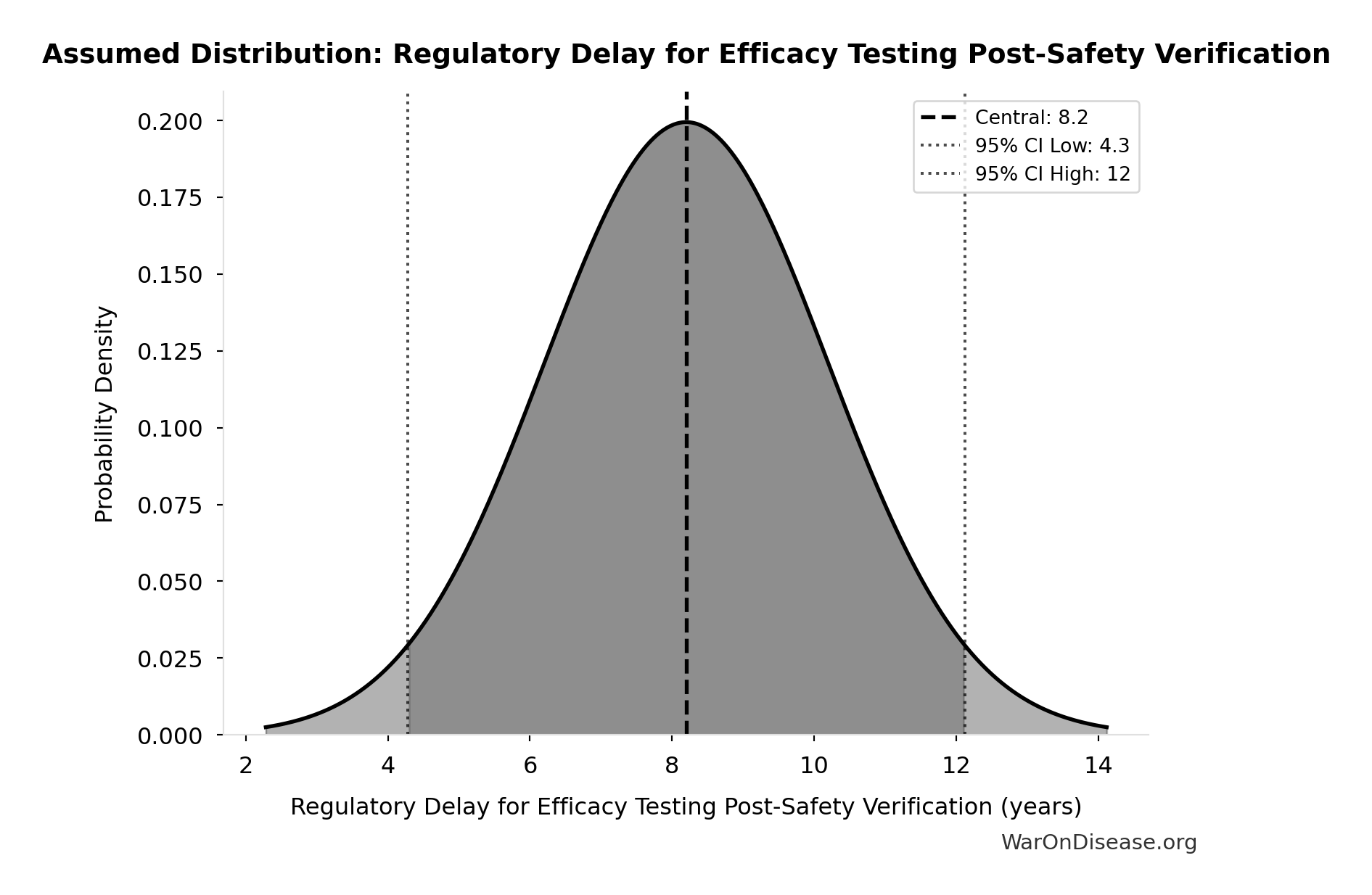

5.5 Post-Safety Efficacy Lag Elimination

A primary health benefit of a decentralized framework for drug assessment comes from eliminating the “efficacy lag”, the 8.2 years (95% CI: 4.85 years-11.5 years) Phase II/III delay between Phase I safety verification and final approval. Critical: This does NOT eliminate safety testing. Phase I safety testing (2.3 years) is preserved.

5.5.1 The Efficacy Lag Problem

A comprehensive quantitative analysis of post-safety efficacy lag costs (1962-2024) found:

- Total Deaths: 416M deaths (95% CI: 225M deaths-630M deaths) eventually avoidable deaths over 8.2 years (95% CI: 4.85 years-11.5 years) efficacy lag (1962-2024)

- Total DALYs: 7.94B DALYs (95% CI: 4.43B DALYs-12.1B DALYs) Disability-Adjusted Life Years lost

- Total Timeline Shift: One-time 8.2 years (95% CI: 4.85 years-11.5 years) acceleration in disease eradication

The analysis shows that for every 1 unit of harm the FDA prevents through safety testing, it generates 3.07k:1 (95% CI: 2.88k:1-3.12k:1) units of harm through efficacy delay (Type II vs. Type I error ratio).

Input: Efficacy Lag Duration Distribution

This chart shows the assumed probability distribution for this parameter. The shaded region represents the 95% confidence interval where we expect the true value to fall.

5.5.2 How a Decentralized Framework Eliminates the Efficacy Lag

Such a framework provides provisional access post-Phase I via trial participation:

- Phase I Safety Testing: Maintained at 2.3 years (no change)

- Post-Phase I Access: Patients can access drugs through trial participation immediately after safety verification

- Continuous Efficacy Monitoring: Real-world evidence replaces the 8.2 years (95% CI: 4.85 years-11.5 years) pre-market efficacy delay

This eliminates the post-safety efficacy lag (the Phase II/III portion, while preserving Phase I safety testing) by enabling real-world evidence collection during trials.

5.5.3 Quantified Benefits (One-Time Timeline Shift)

The elimination of the post-safety efficacy lag by such a framework achieves a one-time 8.2 years (95% CI: 4.85 years-11.5 years) timeline acceleration:

- Total DALYs Averted: 7.94B DALYs (95% CI: 4.43B DALYs-12.1B DALYs) (total one-time impact from 8.2 years (95% CI: 4.85 years-11.5 years) timeline shift)

- Total Economic Value: $1.19 quadrillion (95% CI: $443T-$2.41 quadrillion) (total one-time benefit from timeline shift)

- Deaths Prevented: 416M deaths (95% CI: 225M deaths-630M deaths) (total over the 8.2 years (95% CI: 4.85 years-11.5 years) period)

\[ \begin{gathered} DALYs_{lag} = YLL_{lag} + YLD_{lag} = 7.07B + 873M = 7.94B \\[0.5em] \text{where } YLL_{lag} \\ = Deaths_{lag} \times (LE_{global} - Age_{death,delay}) \\ = 416M \times (79 - 62) \\ = 7.07B \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \\[0.5em] \text{where } YLD_{lag} \\ = Deaths_{lag} \times T_{suffering} \times DW_{chronic} \\ = 416M \times 6 \times 0.35 \\ = 873M \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

\[ \begin{gathered} Value_{lag} \\ = DALYs_{lag} \times Value_{QALY} \\ = 7.94B \times \$150K \\ = \$1190T \\[0.5em] \text{where } DALYs_{lag} = YLL_{lag} + YLD_{lag} = 7.07B + 873M = 7.94B \\[0.5em] \text{where } YLL_{lag} \\ = Deaths_{lag} \times (LE_{global} - Age_{death,delay}) \\ = 416M \times (79 - 62) \\ = 7.07B \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \\[0.5em] \text{where } YLD_{lag} \\ = Deaths_{lag} \times T_{suffering} \times DW_{chronic} \\ = 416M \times 6 \times 0.35 \\ = 873M \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

\[ \begin{gathered} Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

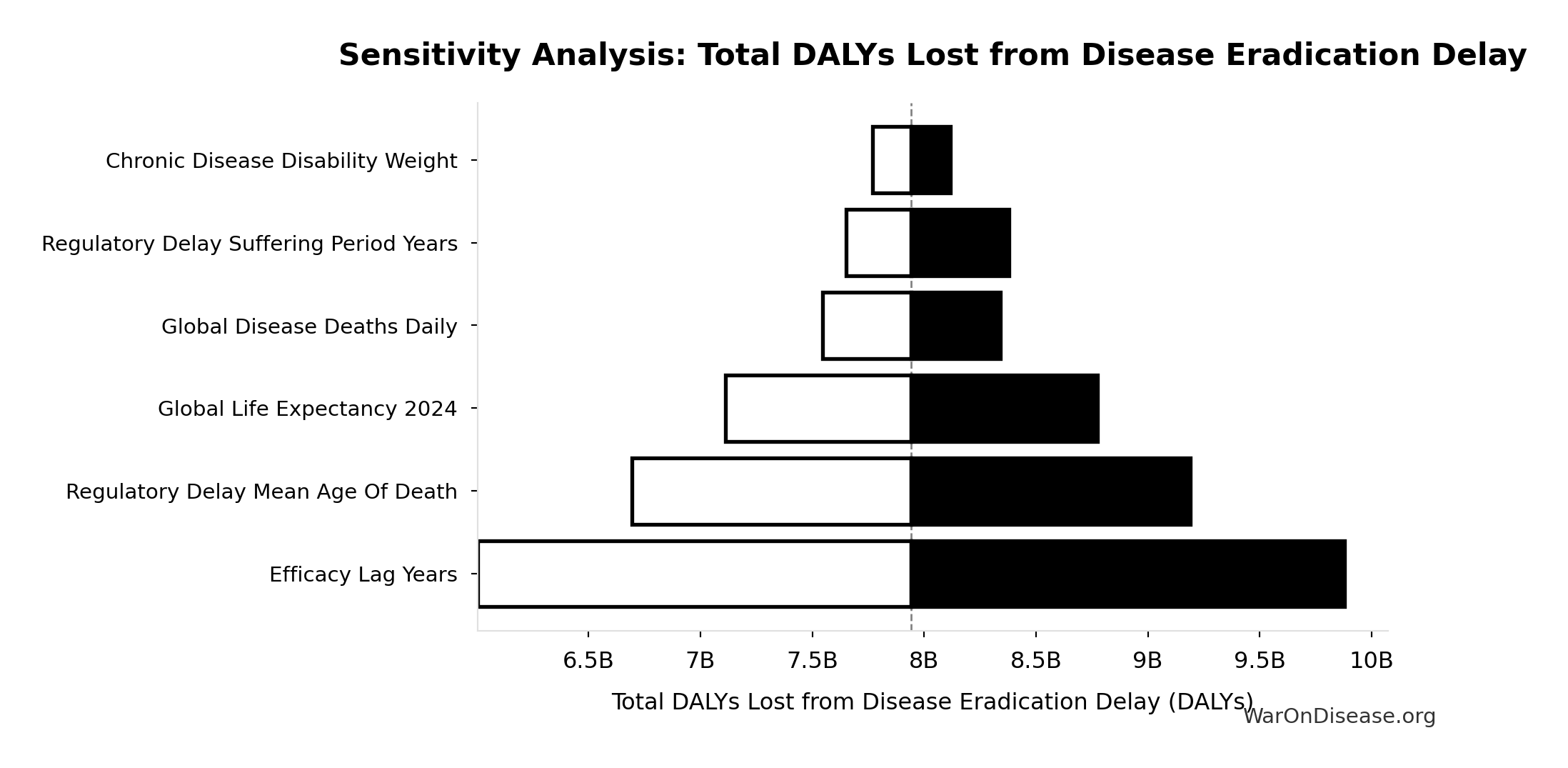

5.5.4 Efficacy Lag Elimination - Uncertainty Analysis

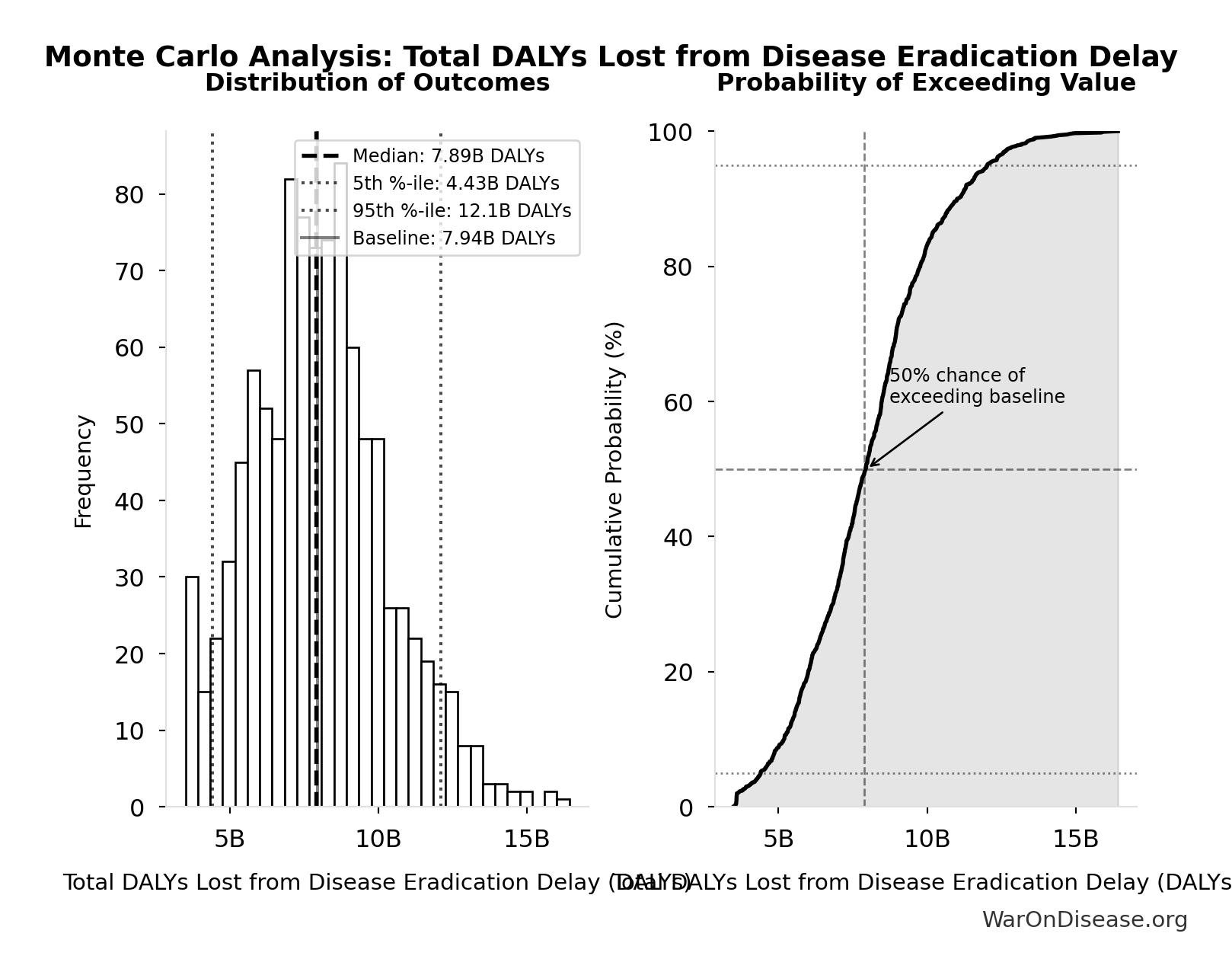

Simulation Results Summary: Total DALYs Lost from Disease Eradication Delay

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 7.94B |

| Mean (expected value) | 8.05B |

| Median (50th percentile) | 7.89B |

| Standard Deviation | 2.31B |

| 90% Confidence Interval | [4.43B, 12.1B] |

The histogram shows the distribution of Total DALYs Lost from Disease Eradication Delay across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

This represents the top-down comprehensive estimate of the health benefits from a decentralized framework from eliminating the post-safety efficacy lag.

For detailed methodology and assumptions, see The Human Cost of Regulatory Latency.

5.6 Safety and Risk Management

Common concern: Won’t faster trials with lower costs compromise safety?

The evidence indicates the opposite. The proposed system provides superior safety monitoring compared to traditional trials across multiple dimensions.

5.6.1 Current System Limitations: Dangerously Blind to Real-World Harms

The current system is not safe - it just appears safe because harms go undetected.

The FDA’s voluntary adverse event reporting system (MedWatch) captures only 1-10% of actual adverse events. Long-term harms that develop gradually over years - the most insidious and deadly kind - are virtually invisible:

- Vioxx (rofecoxib): Caused 38,000-55,000 cardiovascular deaths over 5 years before detection through voluntary reporting. With automated EHR pharmacovigilance, the elevated MI risk would have been detected within 6-12 months.

- Hormone Replacement Therapy: Prescribed for decades before the Women’s Health Initiative revealed increased cancer and cardiovascular risk - risks invisible to voluntary reporting

- Opioids: The overdose crisis killed 500,000+ Americans; the addiction signal was undetectable in short trials with cherry-picked populations

- Avandia (rosiglitazone): 83,000 excess heart attacks estimated before restrictions; signal emerged years post-approval

- Thalidomide (1950s): The disaster that prompted regulatory reform - yet the current system would still miss a thalidomide-like harm if it manifested gradually rather than as obvious birth defects

The current “safety” system doesn’t prevent harm - it delays detection until bodies accumulate. A global automated pharmacovigilance system with continuous EHR monitoring would detect these signals in months, not years or decades.

Specific limitations of the current system:

- Voluntary adverse event reporting captures only 1-10% of actual events

- Traditional Phase III trials test 100-300 patients for 3-12 months, then monitoring stops

- Approximately 50% of trial results go unpublished, with publication bias favoring positive findings 3:1

- 86.1% of patients excluded due to age, comorbidities, or medications - safety signals in these populations go undetected

- Long-term effects (>1 year) rarely captured in pre-approval trials

- No systematic mechanism to detect gradual harms that develop over years

5.6.2 Proposed System Safety Advantages

Preserved Phase I Safety Testing: Rigorous Phase I safety testing (~2.3 years) is maintained. What changes is eliminating the 8.2 years (95% CI: 4.85 years-11.5 years) efficacy delay after safety is verified.

Continuous Population-Scale Monitoring: Pragmatic trials with 10,000-100,000+ participants monitored continuously through EHR integration detect safety problems faster than small, time-limited traditional trials. The RECOVERY trial identified both effective treatments (dexamethasone) and harmful ones (hydroxychloroquine) in under 100 days with 47,000 patients.

Universal Data Collection: The system automatically collects and publishes outcome data on all treatments, eliminating the publication bias that currently hides negative results.

Faster Adverse Event Detection: The Vioxx cardiovascular risk took 5 years to detect through voluntary reporting, resulting in 38,000-55,000 estimated deaths. Automated EHR monitoring would have detected the elevated risk within 6-12 months.

Immediate Mass Notification: When safety signals are detected, all patients taking the drug receive automated alerts through patient portals, enabling immediate clinical review.

5.6.3 Comparative Safety Surveillance

| Safety Dimension | Traditional Trials | Pragmatic Trials + EHR Monitoring |

|---|---|---|

| Sample size | 100-300 patients | 10,000-100,000+ patients |

| Patient selection | 86.1% excluded | All volunteers (real-world populations) |

| Monitoring duration | 3-12 months (then stops) | Continuous via EHR (indefinite) |

| Publication rate | ~50% unpublished | 100% automatically published |

| Adverse event detection | Voluntary reporting (1-10% capture) | Automated surveillance (100% capture) |

5.6.4 Pooled Liability Insurance

The framework includes pooled liability coverage for sponsors, reducing individual company risk while ensuring patient compensation for adverse events. This removes a major barrier to trial participation for smaller sponsors while maintaining accountability.

Type II Error Dominance: For every person protected from an unsafe drug (Type I error prevention), 3.07k:1 (95% CI: 2.88k:1-3.12k:1) people die from delayed access to beneficial treatments (Type II errors). The current system prevents harm from unsafe drugs - but causes 3.07k:1 (95% CI: 2.88k:1-3.12k:1)× more deaths through delays.

The 1962 Amendments Added EFFICACY Requirements, Not Safety

A common misconception: The 1962 Kefauver-Harris Amendment was passed in response to thalidomide, which caused 15.0k cases (95% CI: 10.0k cases-20.0k cases) birth defects globally. But thalidomide was never approved in the US - the existing 1938 Food, Drug, and Cosmetic Act already required safety proof.

What the 1962 amendments actually added was the EFFICACY requirement: drugs must prove they work, not just that they’re safe. This created the modern Phase II/III trial structure - years of efficacy testing after Phase I safety testing is complete.

The irony: 62 amendments designed around a safety crisis created an efficacy bureaucracy. The 8.2 years (95% CI: 4.85 years-11.5 years) delay between Phase I safety verification and final approval has postponed access to beneficial treatments for billions of patient-years since 1962 - not because of safety testing, but because of efficacy proving.

The 3.07k:1 (95% CI: 2.88k:1-3.12k:1) ratio is not a claim that safety testing is worthless. Phase I safety testing is preserved in this framework. The ratio quantifies the cost of the efficacy lag - the years spent proving drugs work after we already know they’re safe. Even if thalidomide-scale events occurred annually (they don’t - thalidomide was exceptional), the math still favors faster post-safety access.

5.6.5 Gross R&D Savings from Implementing a Decentralized Framework

- Parameter: Percentage reduction in addressable clinical trial costs due to a decentralized framework for drug assessment.

- Central Estimate: 97.7% (95% CI: 97.5%-98.9%) (44.1x (95% CI: 39.4x-89.1x))

- Source/Rationale:

- Decentralized Clinical Trials (DCTs) demonstrate significant cost reductions through reduced site management, travel, and streamlined data collection.

- Empirical evidence: ADAPTABLE trial achieved $929 (95% CI: $929-$1.40K)/patient in routine US settings. Harvard meta-analysis of 108 pragmatic trials found median cost of $97 (95% CI: $19-$478)/patient.

- Our estimate: $929 (95% CI: $97-$3K)/patient (vs. $41K (95% CI: $20K-$120K) traditional). This deliberately uses ADAPTABLE as a conservative baseline; actual costs may be lower.

- Confidence interval captures uncertainty from complex chronic disease trials to highly efficient EHR-integrated designs.

The annual gross R&D savings can be calculated as:

\[ S_{\text{annual}} = \alpha \cdot R_d \]

Where:

- \(\alpha \in [0,1]\) is the cost reduction percentage (as decimal)

- \(R_d\) = $60B (95% CI: $50B-$75B) annual global clinical trial spending

Base Case Calculation:

Using 97.7% (95% CI: 97.5%-98.9%) cost reduction (pragmatic trial costs of $929 (95% CI: $97-$3K) vs traditional $41K (95% CI: $20K-$120K)):

\[ \begin{gathered} Benefit_{RD,ann} \\ = Spending_{trials} \times Reduce_{pct} \\ = \$60B \times 97.7\% \\ = \$58.6B \\[0.5em] \text{where } Reduce_{pct} \\ = 1 - \frac{Cost_{pragmatic,pt}}{Cost_{P3,pt}} \\ = 1 - \frac{\$929}{\$41K} \\ = 97.7\% \end{gathered} \]

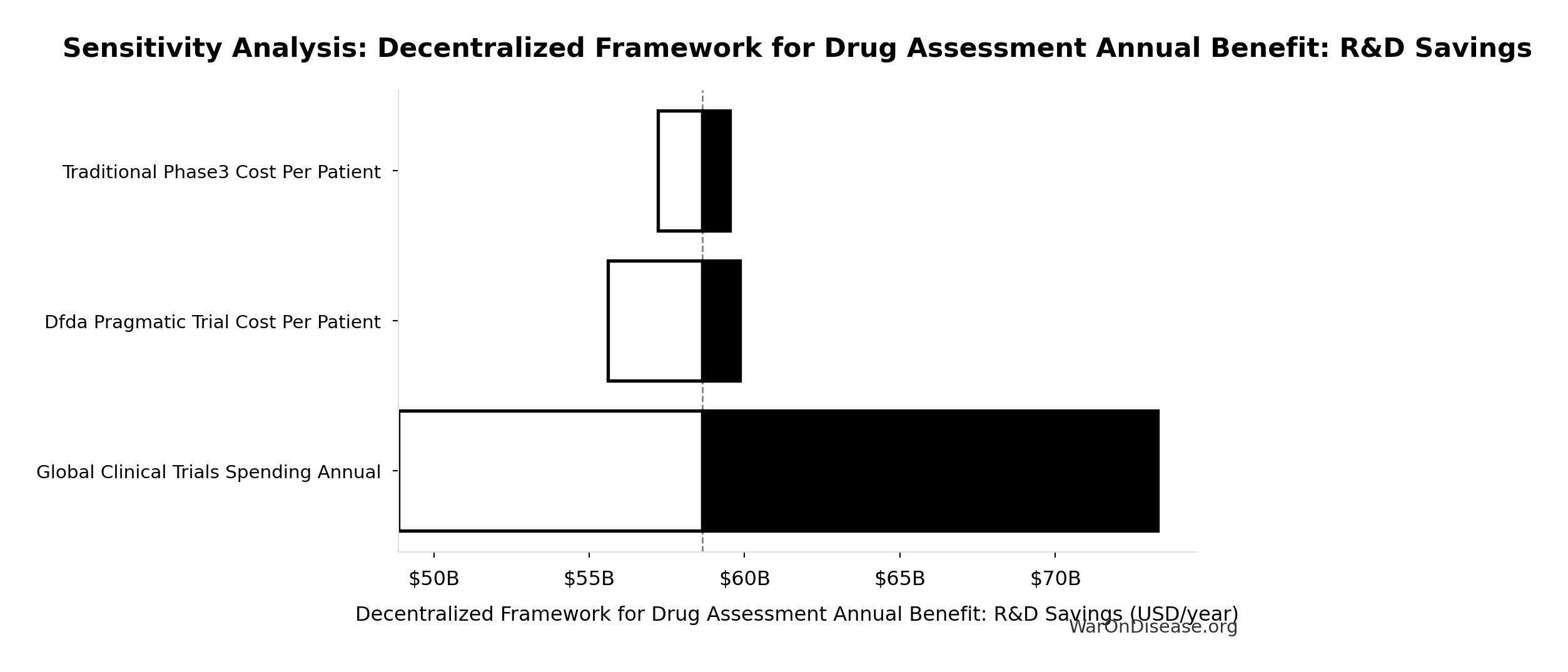

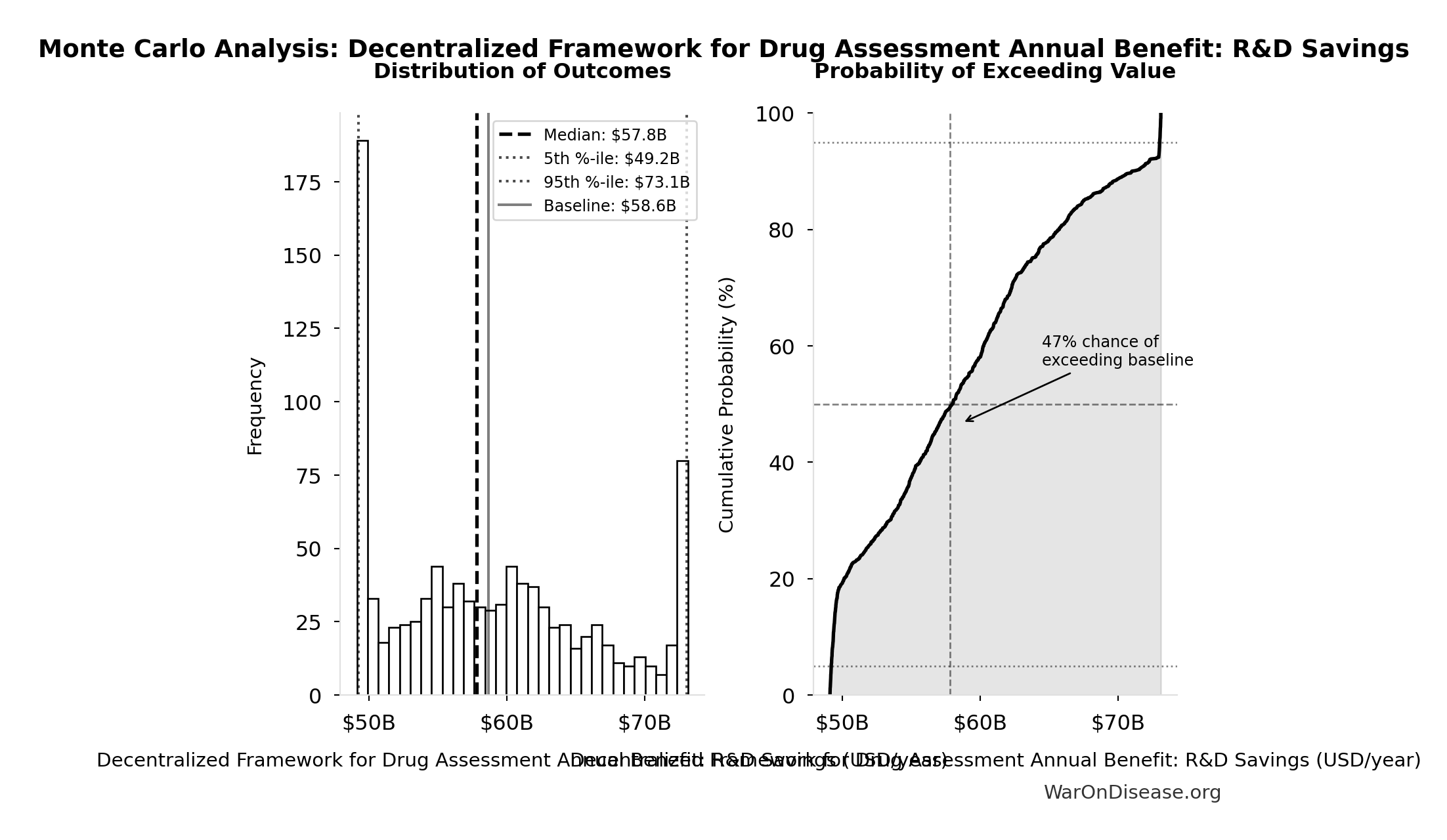

Uncertainty Analysis - R&D Savings:

Simulation Results Summary: Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $58.6B |

| Mean (expected value) | $58.8B |

| Median (50th percentile) | $57.8B |

| Standard Deviation | $7.66B |

| 90% Confidence Interval | [$49.2B, $73.1B] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

5.6.6 Key Sources

6 ROI Analysis for a Decentralized Framework

6.1 Monte Carlo Distributions

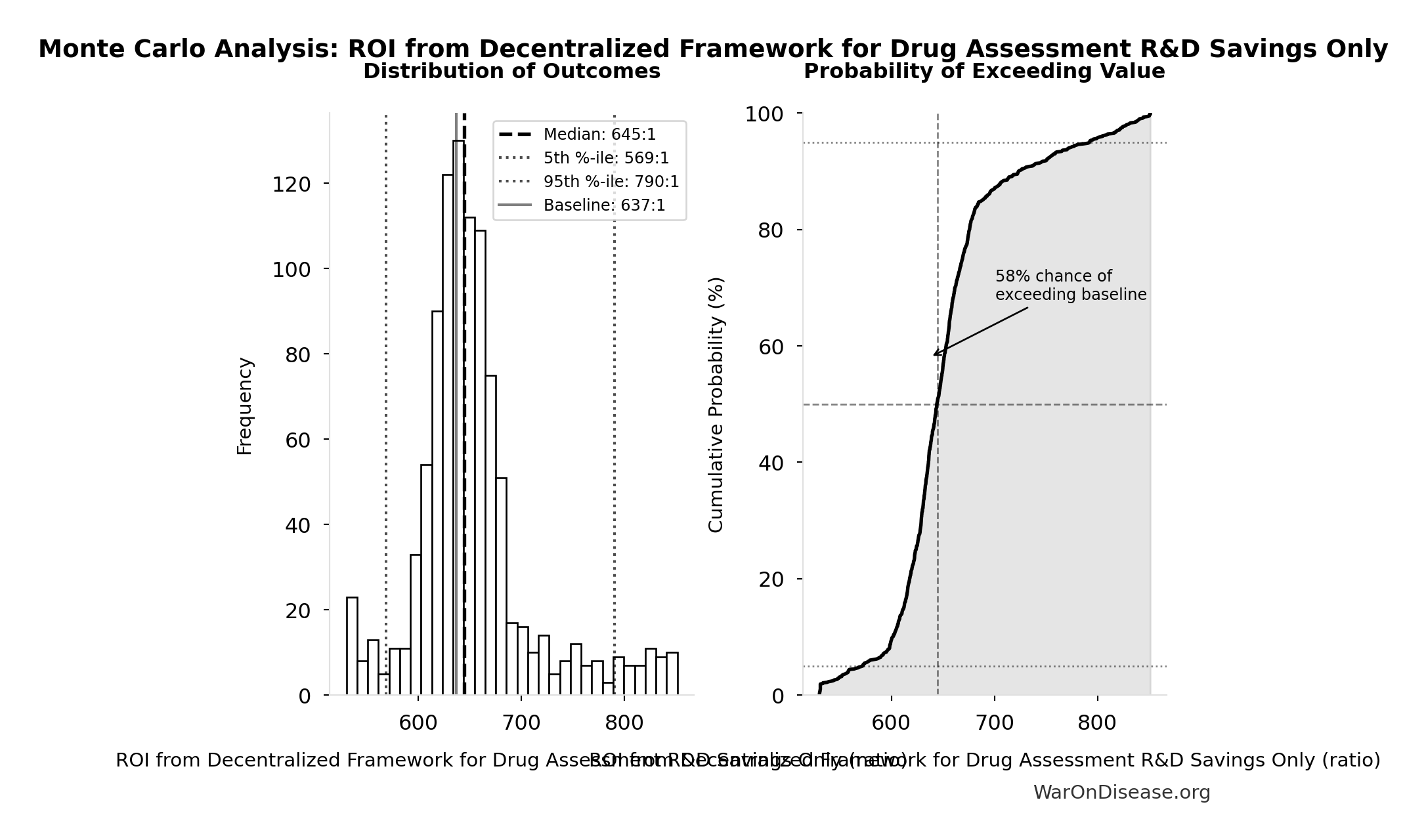

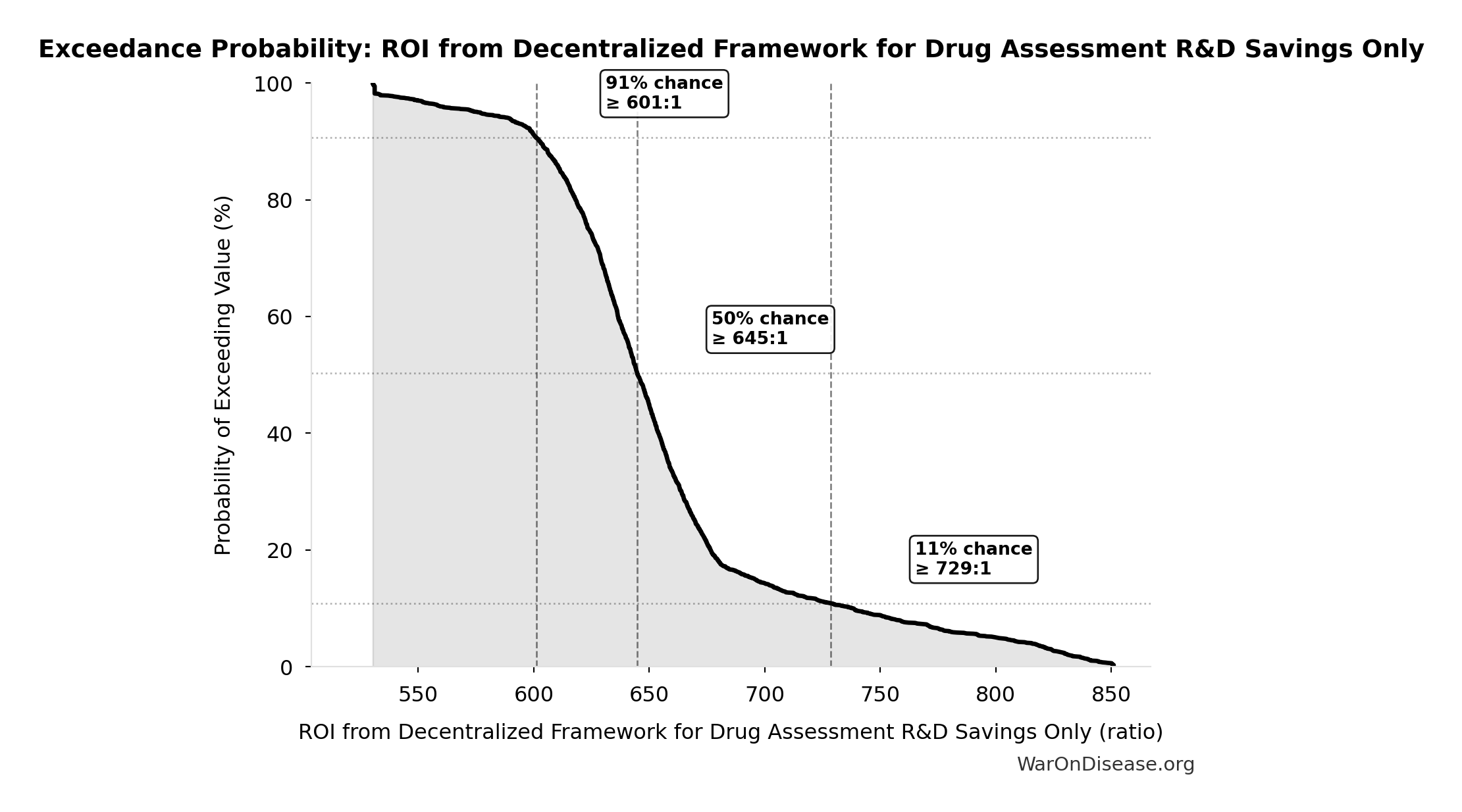

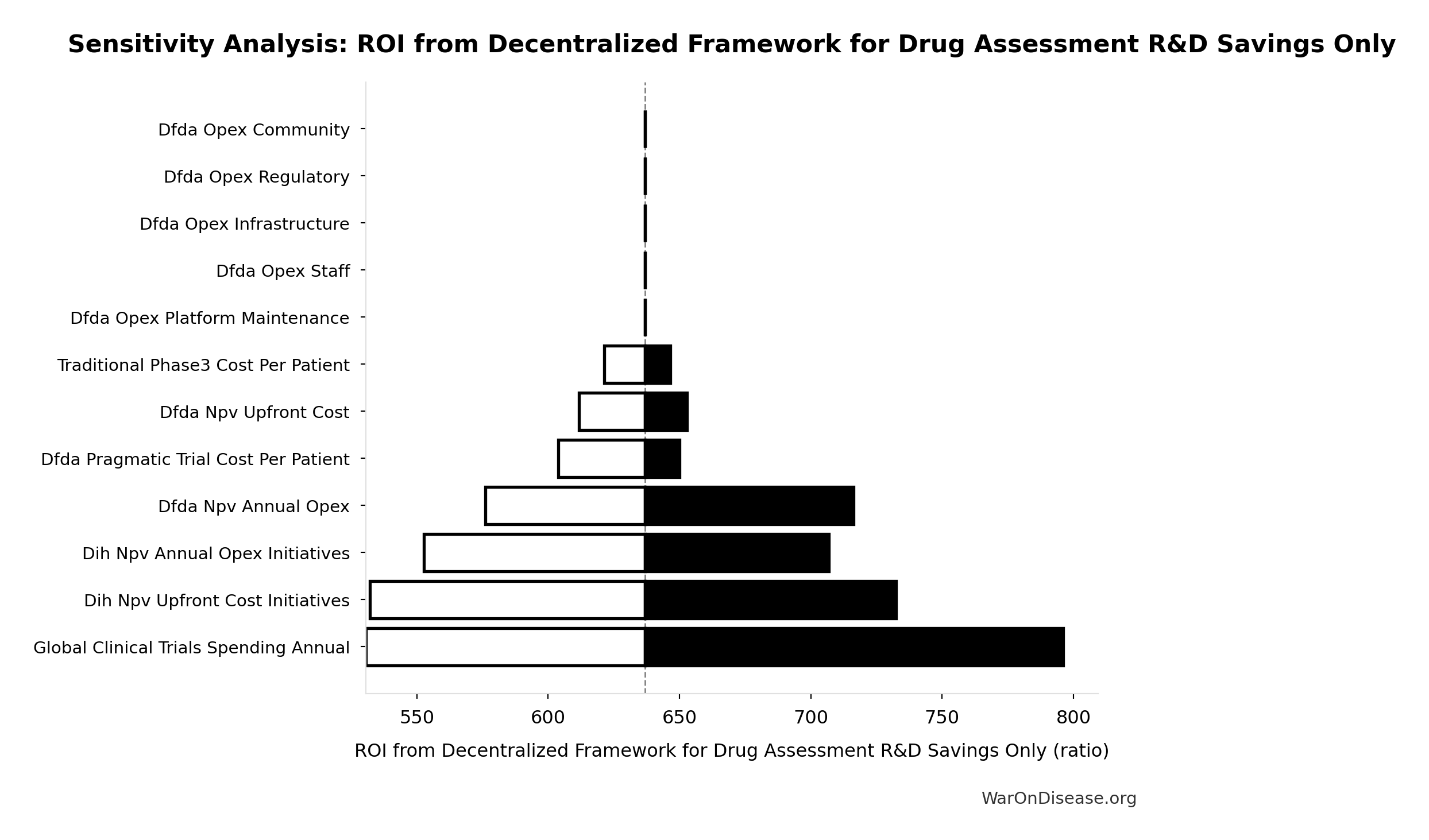

Simulation Results Summary: ROI from Decentralized Framework for Drug Assessment R&D Savings Only

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 637:1 |

| Mean (expected value) | 653:1 |

| Median (50th percentile) | 645:1 |

| Standard Deviation | 58.4:1 |

| 90% Confidence Interval | [569:1, 790:1] |

The histogram shows the distribution of ROI from Decentralized Framework for Drug Assessment R&D Savings Only across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

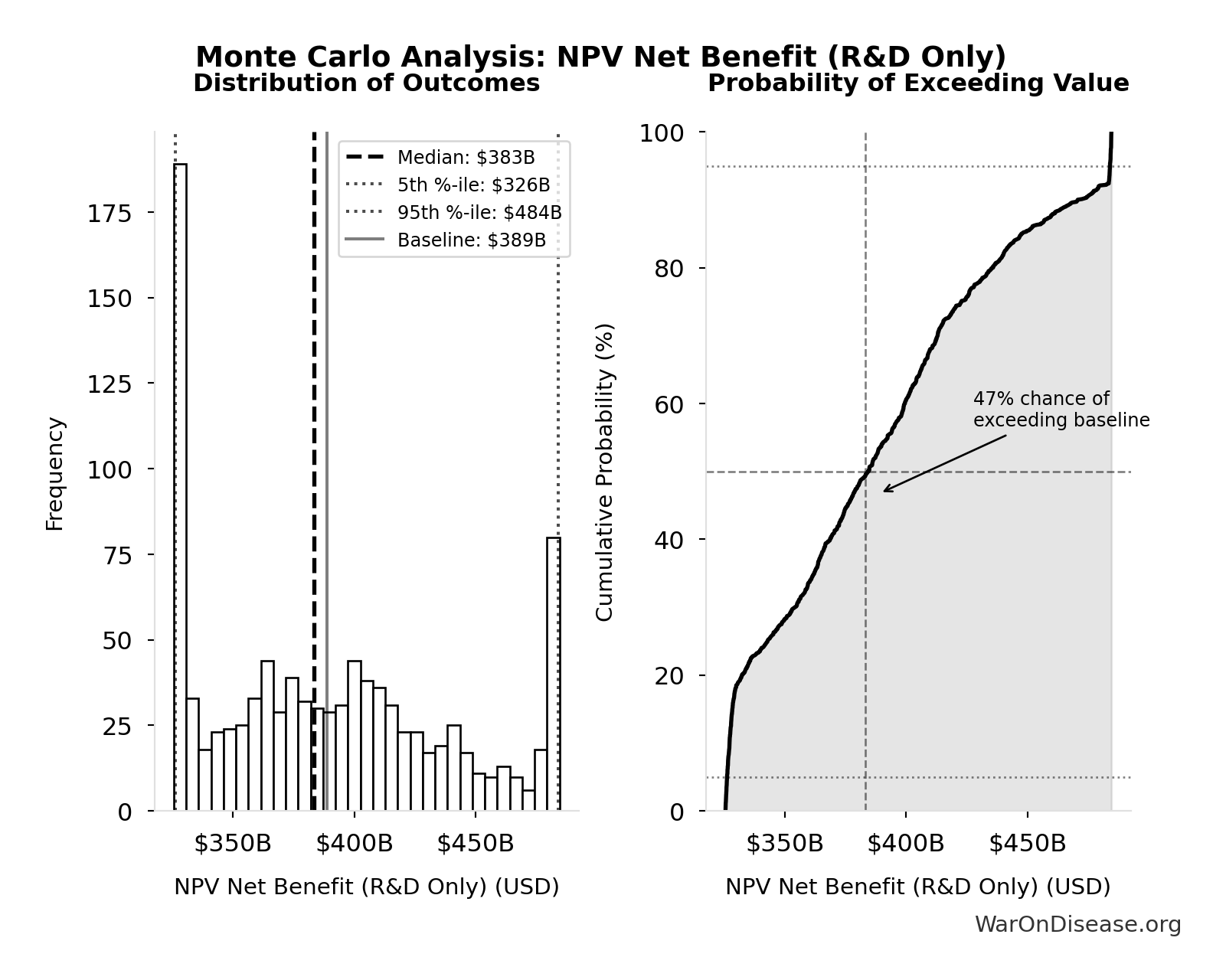

Simulation Results Summary: NPV Net Benefit (R&D Only)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $389B |

| Mean (expected value) | $390B |

| Median (50th percentile) | $383B |

| Standard Deviation | $50.7B |

| 90% Confidence Interval | [$326B, $484B] |

The histogram shows the distribution of NPV Net Benefit (R&D Only) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

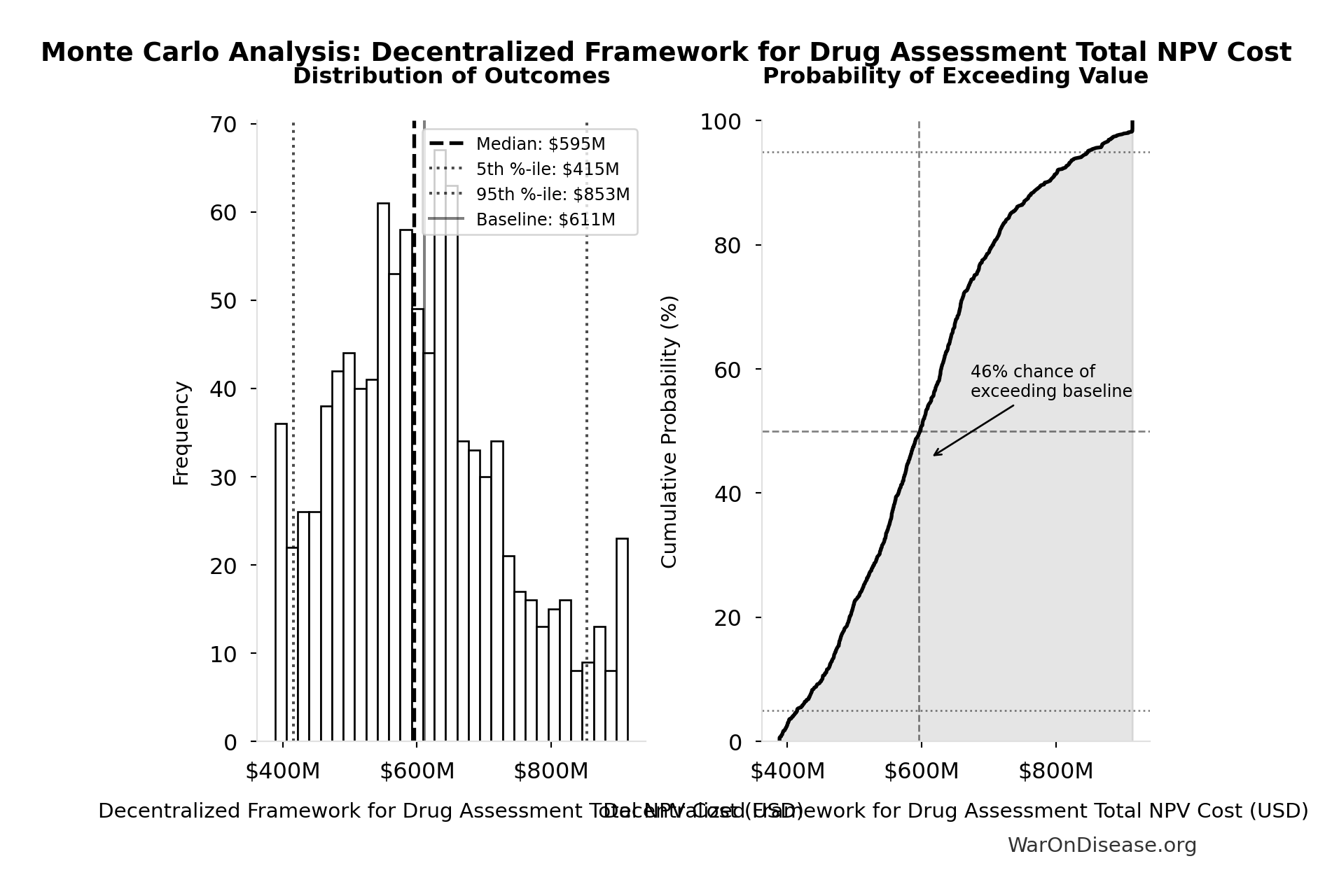

Simulation Results Summary: Decentralized Framework for Drug Assessment Total NPV Cost

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $611M |

| Mean (expected value) | $609M |

| Median (50th percentile) | $595M |

| Standard Deviation | $127M |

| 90% Confidence Interval | [$415M, $853M] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Total NPV Cost across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

This exceedance probability chart shows the likelihood that ROI from Decentralized Framework for Drug Assessment R&D Savings Only will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

7 Broader Impacts on Medical Progress

Acceleration of Approvals

- With continuous, real-time data, new drugs, devices, and off-label uses could gain near-immediate or conditional approvals once efficacy thresholds are met.

- Diseases lacking major commercial interest (rare diseases, unpatentable treatments) benefit from much lower trial costs and simpler recruitment.

Personalized Medicine

- Aggregating genomic, lifestyle, and medical data at large scale would refine “one-size-fits-all” treatments into personalized regimens.

- Feedback loops allow patients and clinicians to see near-real-time outcome data for individuals with similar profiles.

Off-Label & Nutritional Research

- Many nutraceuticals and off-patent medications remain under-tested. Lower cost trials create economic incentives to rigorously evaluate them.

- Could lead to significant improvements in preventive and integrative healthcare.

Public Health Insights

- Constant real-world data ingestion helps identify population-level signals for drug safety, environmental exposures, and dietary patterns.

- Better evidence-based guidelines on how foods, supplements, or lifestyle interventions interact with prescribed medications.

Innovation & Competition

- Lower barriers to entry for biotech start-ups, universities, and non-profits to test new ideas.

- Potential for new revenue streams (e.g., analytics, licensing validated trial frameworks, etc.), leading to reinvestment in R&D.

Healthcare Equity

- Decentralized trials let anyone participate, anywhere. More diverse data, less bias.

- Opens up access to experimental treatments for everyone, not just the rich.

8 Research Acceleration Mechanism

The 12.3:1 (95% CI: 4.19:1-61.3:1) research acceleration transforms our ability to explore the vast therapeutic space where undiscovered cures already exist.

8.1 The Unexplored Therapeutic Frontier

The fundamental problem isn’t that cures are hard to discover. It’s that we’re barely looking:

- 9.50M combinations plausible drug-disease pairings exist (9.50k compounds (95% CI: 7.00k compounds-12.0k compounds) safe × 1.00k diseases (95% CI: 800 diseases-1.20k diseases))

- Only 0.342% (95% CI: 0.21%-0.514%) of these combinations have been tested - 99.7% (95% CI: 99.5%-99.8%) remains unexplored

- Only 12% of the human interactome has ever been targeted by drugs

- 30% of approved drugs gain new indications, proving undiscovered uses exist

\[ \begin{gathered} Ratio_{explore} = \frac{N_{tested}}{N_{combos}} = \frac{32{,}500}{9.5M} = 0.342\% \\[0.5em] \text{where } N_{combos} \\ = N_{safe} \times N_{diseases,trial} \\ = 9{,}500 \times 1{,}000 \\ = 9.5M \end{gathered} \]

The cures likely already exist among tested-safe compounds. We just haven’t looked. See The Untapped Therapeutic Frontier for detailed analysis of this exploration gap.

8.2 Current Exploration Rate vs. Therapeutic Space

Under the status quo:

- 6.65k diseases (95% CI: 5.70k diseases-8.24k diseases) currently lack effective treatment

- 15 diseases/year (95% CI: 8 diseases/year-30 diseases/year) receive their first effective treatment

- At this exploration rate, systematically searching the remaining 99%+ of therapeutic space would take ~443 years (95% CI: 324 years-712 years)

\[ \begin{gathered} T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \end{gathered} \]

This calculation is empirically grounded: only ~5% of 7.00k diseases (95% CI: 6.00k diseases-10.0k diseases) have FDA-approved treatments after 40+ years of the Orphan Drug Act. At the current rate of 15 diseases/year (95% CI: 8 diseases/year-30 diseases/year) getting first treatments, most of the therapeutic space remains permanently unexplored.

With dFDA implementation:

- Trial capacity increases 12.3:1 (95% CI: 4.19:1-61.3:1), enabling parallel exploration of the therapeutic space

- Exploration rate: 185 diseases/year (95% CI: 107 diseases/year-490 diseases/year) receiving first treatments (vs 15 diseases/year (95% CI: 8 diseases/year-30 diseases/year) status quo)

- Time to systematically explore disease space: 36 years (95% CI: 11.6 years-77.2 years) (vs 443 years (95% CI: 324 years-712 years))

\[ \begin{gathered} Treatments_{dFDA,ann} \\ = Treatments_{new,ann} \times k_{capacity} \\ = 15 \times 12.3 \\ = 185 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

\[ \begin{gathered} T_{queue,dFDA} = \frac{T_{queue,SQ}}{k_{capacity}} = \frac{443}{12.3} = 36 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

Additionally, eliminating the 8.2 years (95% CI: 4.85 years-11.5 years) efficacy lag means discovered treatments reach patients immediately. The total timeline shift is 212 years (95% CI: 135 years-355 years) (discovery acceleration + efficacy lag elimination).

8.3 Addressing the Returns Question: Diminishing, Linear, or Compounding?

A common objection is that “more trials won’t produce proportionally more cures” - the diminishing returns hypothesis. This deserves serious consideration, but the evidence suggests the opposite may be true.

8.3.1 Why Diminishing Returns Is Unlikely (We Haven’t Started Looking)

The diminishing returns objection assumes we’ve exhausted low-hanging fruit. But we’ve barely begun:

- Single compounds alone: 9.50M combinations possible combinations of known safe compounds × diseases. At current trial capacity, systematically testing these would take 2.88k years (95% CI: 2.45k years-3.43k years). We won’t finish until the year 5000+.

\[ \begin{gathered} T_{explore,safe} \\ = \frac{N_{combos}}{Trials_{ann,curr}} \\ = \frac{9.5M}{3{,}300} \\ = 2{,}880 \\[0.5em] \text{where } N_{combos} \\ = N_{safe} \times N_{diseases,trial} \\ = 9{,}500 \times 1{,}000 \\ = 9.5M \end{gathered} \]

Combination therapies expand the space: Modern medicine relies on multi-drug regimens (oncology, HIV, cardiology). Pairwise combinations of safe compounds create 45.1B combinations possibilities, requiring 13.7M years (95% CI: 11.6M years-16.3M years) at current pace - longer than Homo sapiens has existed.

Repurposing success proves cures exist: 30% of approved drugs gain new indications, demonstrating the unexplored space contains discoveries.

Most biology is untargeted: Only 12% of the human interactome has been targeted. We’re ignoring 88% of our own biology.

RECOVERY found treatments in months: The Oxford trial discovered multiple effective COVID treatments rapidly because it looked systematically.

You cannot have diminishing returns when you’ve barely started.

8.3.2 The Conservative Default: Linear Assumption

Our analysis uses a conservative linear returns assumption - each dollar of additional trial funding produces the same marginal benefit as the last. This is almost certainly pessimistic because:

- Network effects in data aggregation improve predictions over time

- Each discovery informs future research directions

- Platform infrastructure becomes more efficient with scale

If returns are actually compounding (plausible given platform effects), our estimates are substantially conservative.

9 Data Sources and Methodological Notes

Cost of Current Drug Development:

- Tufts Center for the Study of Drug Development often cited for $1.0 - $2.6 billion/drug.

- Journal articles and industry reports (IQVIA, Deloitte) also highlight $2+ billion figures.

- Oxford RECOVERY trial: $500 (95% CI: $400-$2.50K)/patient (exceptional NHS/COVID conditions). ADAPTABLE trial: $929 (95% CI: $929-$1.40K)/patient (typical US pragmatic trial). Our projections use $929 (95% CI: $97-$3K)/patient based on ADAPTABLE; confidence interval captures uncertainty.

ROI Calculation Method:

- Simplified approach comparing aggregated R&D spending to potential savings.

- Does not account for intangible factors (opportunity costs, IP complexities, time-value of money) beyond a basic Net Present Value (NPV) perspective.

Scale & Adoption Rates:

- The largest uncertainties revolve around uptake speed, regulatory harmonization, and participant willingness.

- Projections assume widespread adoption by major pharmaceutical companies and global health authorities.

Secondary Benefits:

- Quality-of-life improvements, lower healthcare costs from faster drug innovation, and potentially fewer adverse events from earlier detection.

- These are positive externalities that can significantly enlarge real ROI from a societal perspective.

10 Daily Opportunity Cost of Inaction

This section quantifies the daily societal cost of maintaining the status quo, framed as the opportunity cost of not implementing an infrastructure for a decentralized framework for drug assessment. By translating the annualized benefits identified in this analysis into a daily metric, you can better appreciate the urgency of the proposed transformation. The “cost of inaction” is the value of the health gains (QALYs) and financial savings (R&D efficiencies) that are forgone each day such a system is not operational.

10.0.1 Base Case: Daily Lost QALYs and Financial Savings

The calculations below are based on the central (“base case”) estimates established in the preceding sections of this analysis.

- Total DALYs at Stake:

- The analysis (Regulatory Mortality Analysis) projects 7.94B DALYs (95% CI: 4.43B DALYs-12.1B DALYs) Disability-Adjusted Life Years (DALYs) averted from eliminating the regulatory efficacy lag. This represents the one-time health benefit from accelerating the cure timeline.

- Daily R&D Waste:

- The analysis (Gross R&D Savings) projects gross R&D savings of $58.6B (95% CI: $49.2B-$73.1B) per year by reducing the costs of the $60B (95% CI: $50B-$75B) global clinical trial market by 97.7% (95% CI: 97.5%-98.9%). This represents value that is currently being spent inefficiently.

- The daily financial loss from this inefficiency is: